Why Kenya Has Positioned Itself As A Key Carbon Credit Market In Africa?

May 25, 2024

Why Kenya Has Positioned Itself As A Key Carbon Credit Market In Africa?

May 25, 2024

Key Insights

- Kenya has positioned itself as a leading carbon credit market in Africa, driven by its energy transition to renewables, high traded carbon credit volumes, and supportive policy environment, with significant contributions from forestry, land use, and agriculture sectors.

- Blockchain technology is enhancing Kenya’s carbon credit market through projects like CYNK, Shamba Network, and Verst Carbon, which focus on verifiable carbon markets, monitoring, reporting, and verification, as well as tokenization of carbon credits.

- Key stakeholders, such as the National Climate Change Council, National Environment Management Authority (NEMA), and Nairobi Securities Exchange, are crucial in guiding policy, authorizing projects, and facilitating carbon credit trading, supported by a developing regulatory framework.

Primer

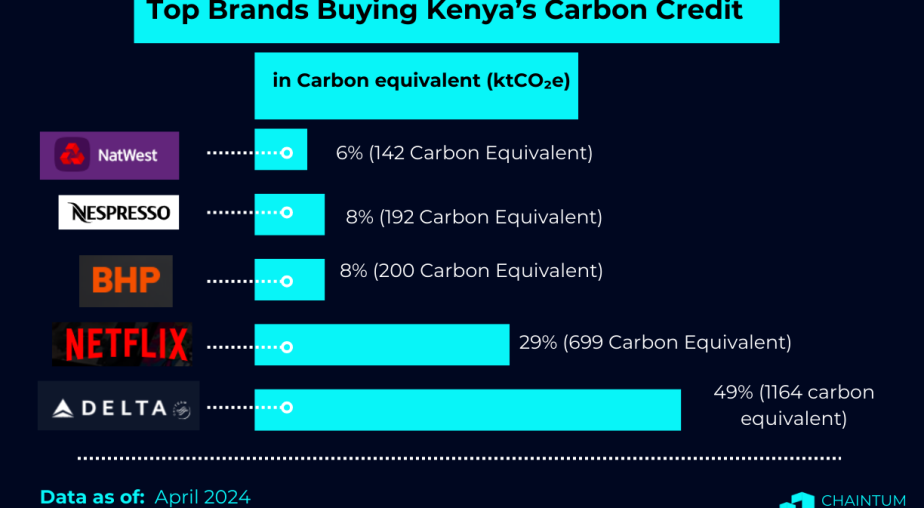

For a good reason, Kenya has attracted big brands clamouring for its carbon credits.

What market factors contribute to this trend?

A Favorable Policy Environment on the Cards

Pre-Climate Act Issues

- Carbon finance and carbon markets in Kenya were in a legal limbo before the Climate Act amendment.

- The issues included, allegations of exploitation of Kenyan farmers and local communities by carbon project proponents, skewed benefit-sharing arrangements, wrong reporting of carbon emission reduction, forceful evictions, and cultural disruption.

- The Governor of Kajiado County issued a notice revoking all carbon credit contracts between private entities and local communities in June 2023.

Amendment of Climate Act

- The Climate Change Act, No 11 of 2016, was amended in September 1 2023 to provide regulation of carbon markets in Kenya.

- The Act now establishes a national carbon registry and regulates trade in carbon credits.

- Carbon trading projects are required to undergo mandatory environmental and social impact assessment under Kenya’s environmental laws.

- Community development agreements are introduced to regulate the relationship and obligations of project proponents with impacted communities in carbon trading projects

Proposed Legislative Changes

- The Carbon Credit Trading and Benefit Sharing Bill, 2023 is undergoing legislative process in Kenya.

- The Bill proposes the introduction of carbon trading permits, benefit-sharing ratios, a Carbon Credit Trading Register, greenwashing offences, a Carbon Trading and Benefit Sharing Authority, and a Carbon Credit Trading Tribunal.

- Potential overlap between the proposed Carbon Trading Bill and the amended Climate Act,

especially in community development/benefit sharing agreements and benefit-sharing

ratios. - The Carbon Trading Bill is in early legislative stages and may undergo significant changes.

Takeaways

- The proposed amendments represent a legal step toward Kenya’s reaction to climate change, helping to meet its international obligations under Africa’s Agenda 2063, the Paris Climate Change Agreement, and the United Nations Agenda 2030 for Sustainable Development.

- Kenya joins South Africa, India, Indonesia, and Vietnam in establishing domestic carbon trading markets.

Regulatory Requirements for Companies

- Companies in Kenya will likely be required to disclose their environmental sustainability performance in addition to their usual quarterly profit reports.

- The first global sustainability reporting standards, IFRS S1 and IFRS S2 will be launched in Kenya on September 5.

- Kenya is expected to withdraw the first funds from the $551.4 million Resilience and Sustainability Facility (RSF) secured from the International Monetary Fund (IMF) on November 7, requiring it to demonstrate that climate risk consideration has been incorporated into its national planning and investment framework.

Top Carbon Blockchain-Based Carbon Credit Projects in Kenya

- CYNK has launched Africa’s first verifiable carbon market in Kenya.

- Kenya’s Shamba Network uses blockchain to monitor, report, and verify carbon credit creation on smallholder farms.

- Verst Carbon uses a blockchain-enabled platform to unlock finance, improve community governance, and enhance carbon market integrity.

- Nexum, Inc. Foundation, HBKDOP, and The ClimateGroup Africa launched a new online carbon credits exchange that will also tokenize carbon credit.

Takeaways

- Most projects are focused on carbon exchange, tokenization, monitoring, reporting, and verification.

- Most initiatives are private-led and aim to promote social and economic impact.

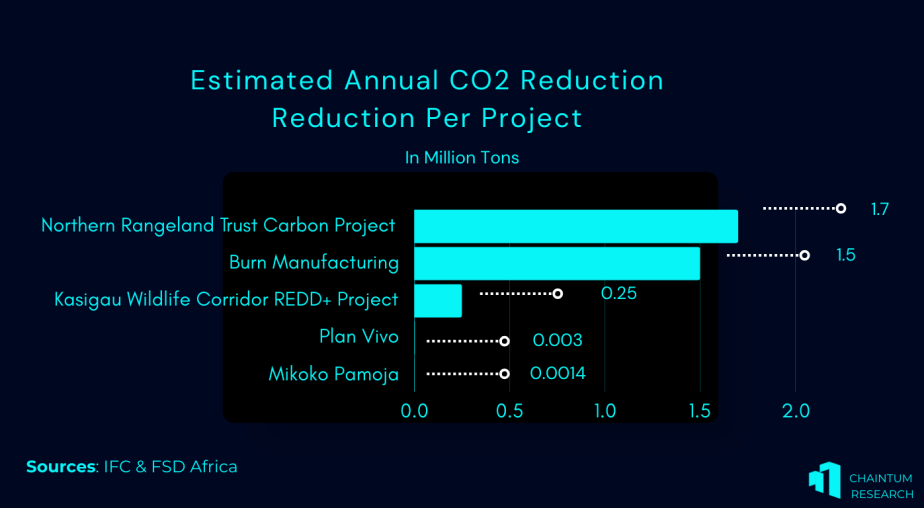

Non-Blockchain Carbon Credit Projects in Kenya

Takeaway

Go-To Stakeholders in Carbon Credit Market

- National Climate Change Council: Provides guidance and policy direction on carbon markets to national and county governments, the public, and other stakeholders.

- The Cabinet Secretary: Advises the National Climate Change Council on the carbon budget available for trading and approves the measurement, reporting, and verification of greenhouse gas emissions.

- Designated National Authority (DNA)- The National Environment Management Authority (NEMA): Authorizes participation in projects under the Paris Agreement and maintains a National Carbon Registry.

- Rural Electrification and Renewable Energy Corporation (REREC): Tasked with harnessing opportunities under clean development mechanisms and carbon credit trading.

- Kenya Forest Service (KFS): Beneficiary of carbon trading

- Kenya Electricity Generating Company (KenGen): booked Sh12.7 million in revenue from trading carbon credits.

- Nairobi Securities Exchange: It has taken steps to reduce its carbon footprint.

World Bank's Recommendations on Areas for Growth in Kenya's Carbon Market.

- Forestry and land use: High potential due to Kenya’s large forest and wetland coverage.

- Agriculture: Large sector with potential for climate-smart agriculture due to market interest.

- Industrial processes: Cement manufacturing offers significant opportunities for GHG emissions reduction.

- Waste management: The large volume of waste and government attention to the Sustainable Waste Management Act (2022) present opportunities.

Challenges to the Growing Carbon Market

- Kenyan firms have limited awareness of carbon markets, as well as the competence to verify and validate carbon projects.

- Limited access to affordable finance sources for projects and methods for financiers to de-risk investments

- Policies and laws governing land rights, carbon credit ownership, taxation policy, and domestic Article 6 regulation affect businesses that implement carbon projects amidst uncertainty surrounding the Climate Change Amendment Bill.

- Carbon credit rates vary by project type and year, and carbon credits are generated at least two years after project inception.

- Certification standards developers, third-party verifiers, project developers, and other ecosystem participants are outside Africa.

Trends to Capitalize on in the Next Decade in the Market

- Increased corporate commitments and industry schemes to reduce carbon footprints.

- Carbon credit buyers will pay more attention to project quality and integrity, which entails robust digitized monitoring, reporting, and verification (MRV).

- Nature-based and tech-based projects will command a greater share of VCM trading volumes and higher market prices.

Subsribe To Our Newsletter

Stay in touch with us to get latest news and announcements