DRC's Carbon Credit -The Pinnacle of Green Revolution in Africa

Jul 03, 2024

DRC's Carbon Credit -The Pinnacle of Green Revolution in Africa

Jul 03, 2024

Key Insights

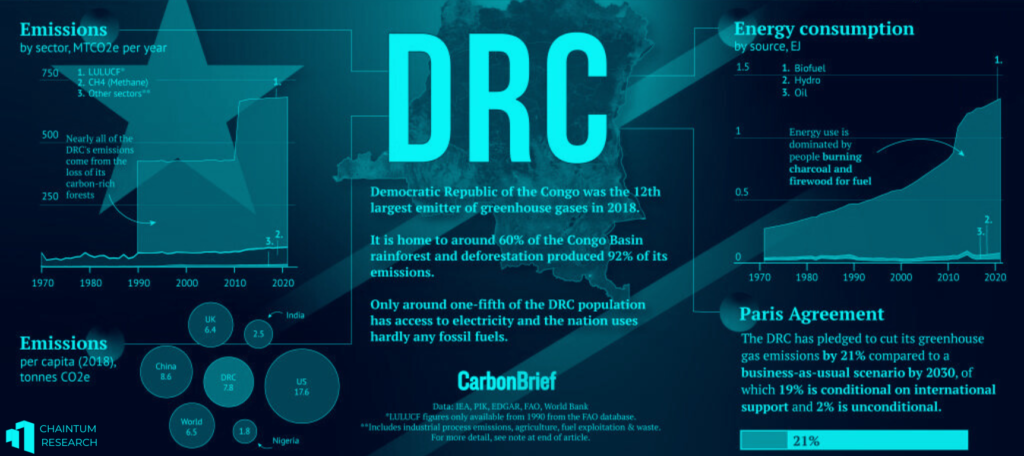

- The DRC’s vast Congo Basin, holding around 24 billion metric tonnes of carbon, positions the country as a prime target for carbon credit investments, attracting notable interest from global firms like dClimate, Flowcarbon, and Co2Bit.

- he DRC has established a national authority for carbon trading and formed international partnerships with countries and foundations, securing a $62 million initial funding commitment to support its carbon credit initiatives and conservation efforts.

- The DRC’s carbon credit market faces challenges, including weak regulatory frameworks and corruption. However, there are opportunities to improve MRV practices, ensure effective credit valuation, and implement equitable benefit-sharing mechanisms within local communities.

Primer

- Why has attention suddenly shifted to the Democratic Republic of the Congo (DRC) in a new wave of carbon credit revolution sweeping across Africa?

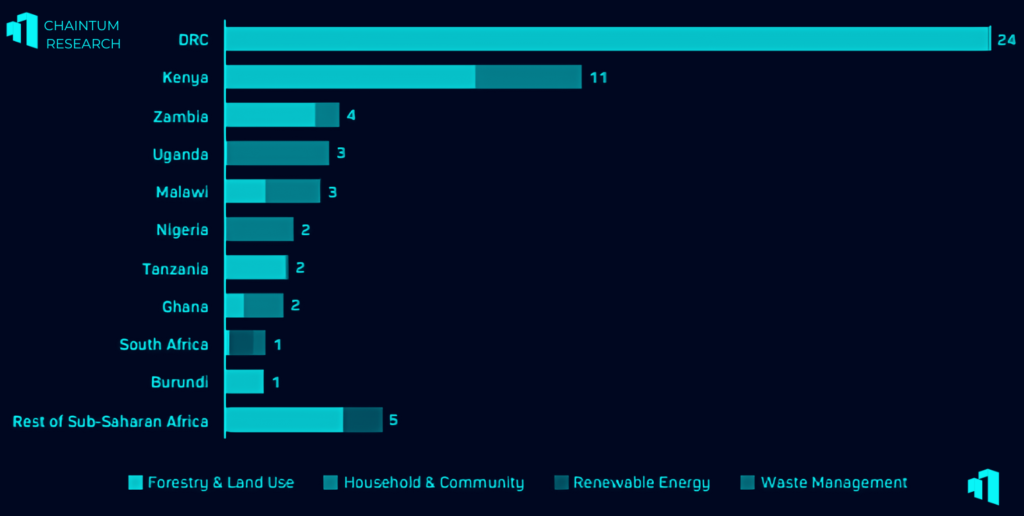

- In my last post, we saw how Kenya has positioned itself as a key carbon credit market in Africa.

- A nation notorious for political volatility, catastrophic poverty, and corruption is making the correct steps in the carbon credit market.

- The Congo Basin, the world’s second-biggest tropical rainforest, holds around 24 billion metric tonnes of carbon.

- This phenomenon makes the country attractive for carbon credit investors and technopreneurs, including blockchain players.

Let’s dive right into it.

Photo by Carbon Brief in https://interactive.carbonbrief.org

The Mark Cuban Interest

- Mark Cuban-backed business dClimate has struck a preliminary agreement with the DRC to produce $1 billion in carbon credits.

- dClimate will reward the Congo for protecting 500,000 hectares of peatlands, reducing the emission of 100 million tons of CO2 over a decade.

- dClimate will monitor the preserved area, assist the DRC in establishing a carbon-credit register, and sell the resulting credits on the open market.

- The deal corresponds with national development goals and will begin in 2024.

Other Blockchain-Based Carbon Credit Players in DRC

Flowcarbon

- Flowcarbon, co-founded by WeWork’s Adam Neumann, seeks to convert carbon credits into crypto assets in DRC.

- Flowcarbon is partnering with RedemptionDAO, which crowdfunded and raised less than $3 million of its $50 million goal.

- RedemptionDAO, the campaign launched via Telegram and Discord, aimed to purchase 1 out of 30 oil exploration blocks in partnership with an oil company to issue “avoided emissions” carbon credits.

Co2Bit

- Co2Bit is creating an AI system for measuring and evaluating long-term project effects in DRC.

- The platform comprehensively assesses carbon emissions, habitat protection, societal well-being, and ecological stability and sustainability.

Changeblock

- Developed using the Cardano Blockchain architecture for the safe trade, settlement, and custody of environmental assets.

- Tokenization and fractional ownership solutions are available to make the market more liquid.

- Smart contracts automate processes, reduce transaction costs, and mitigate fraud risks.

- Offers AI-powered risk management and immediate data analysis for trading possibilities.

- Offers a variety of environmental assets, including voluntary compliance, taxes, and methane credits.

FG Capital

- FG Capital Advisers launched a carbon credit token and platform to help promote sustainability initiatives throughout the Congo Basin.

- The effort seeks to mitigate the harm caused by intrusive mining by businesses and individuals.

Non-Blockchain Carbon Credit Projects

The Mai Ndombe REDD+ Carbon Credit Project

- Wildlife Works’ Mai Ndombe REDD+ project covers around 300,000 hectares of former logging concessions and is estimated to eliminate more than 100 million tons of CO2 emissions over the next 30 years.

- It aims to build 20 schools, construct healthcare facilities, provide transportation to off-concession markets, establish a network of rural canteens, improve agricultural production practices, and hire local community members.

DRC Redd+ Carbon Credit Harvesting Project

- Protects 6,793,190 hectares of forest against industrial logging, unsustainable fossil fuels extraction, and slash-and-burn farming.

- GEC Communities II, Inc. serves as the General Partner for R.E.D.D. Carbon Credit Harvesting LP and Global Treat Corporation.

- Utilizes VM0009 ‘Methodology for Avoided Deforestation’ v3.0, which was verified by VCS in 2011.

- The project will generate more than 4.3 billion tCO2-e during the next 30 years.

DRC's Carbon Credit Legal Environment

Revised Law of 2011 (Loi révisée de 2011 par l’O-L de 2023)

– In 2023, a 2011 law was amended to include carbon markets, Article 6 of the Paris Agreement,

and a carbon tax, but uncertainties remain regarding its exact scope and nature.

Other Regulations and Agreements

– There are regulations and agreements related to projects like REDD+ and mechanisms for

resolving complaints and grievances.

National Agency for the Reduction of the Harmful Consequences of Climate Change Activities (ANRMCA) Establishment

– The law was founded by order, but it has yet to become operational.

Enablers

- The DRC has announced its partnership for the New Climate Economy at COP28, with international partners including the United States, France, Germany, the United Kingdom (UK), Norway, the Bezos Earth Fund, the Seed Fund, the David and Lucile Packard Foundation, Forest People Climate, Rockefeller Brothers, and Southbridge Investments. The partnership involves a $62 million initial funding commitment.

- DRC President Felix Tshisekedi has urged the international community to utilize the country’s natural assets for decarbonization, local development, and global climate resilience.

- The DRC has initiated a government process to conserve 700,000 km² (130 million acres) by 2030.

- The DRC has established a national authority responsible for carbon trading.

- The DRC has collaborated with Nairobi Framework Partnership Partners (UNFCCC, UNEP, FAO) and the International Emissions Trading to develop procedures for carbon credit exchange.

- The DRC is allowing carbon credit and cryptocurrency firms to take part in an oil and gas license round.

- Congo has auctioned 30 oil and gas exploration blocks, some in Virunga National Park and the Cuvette Central, the world’s largest tropical peatland.

- Rawbank SA, the largest bank in the DRC, is launching the country’s first carbon credit trading desk, which will involve Vitol Group, an iconic carbon credit market. The firm will invest $20 million to discover prospective offset projects in the market.

- DRC ranks first for the voluntary carbon market in Sub-Saharan Africa, issuing 24 million credits.

Photo by World Bank in https://documents1.worldbank.org/

Challenges in DRC's Carbon Credit Industry

- The carbon investing market faces challenges such as weak regulatory frameworks, proliferation of investment actors, and corruption in many countries.

- Political ambition and commitment are often insufficient, with MRV practices sometimes falling short of implementation.

- There are concerns regarding the current legal structure, non-participatory development processes, lack of energy sector consideration, and lack of consensus on benefit-sharing mechanisms.

Opportunities in DRC's Carbon Credit Market

- There is a need for more MRV (Monitoring, Reporting, and Verification) to ensure transparency and accountability within the carbon credit system.

- Effective credit valuation poses significant challenges, especially in remote and socially complex areas with extended time horizonss.

- Effective local benefit sharing that focuses on equitable distribution of carbon market-generated benefits within communities.

Subsribe To Our Newsletter

Stay in touch with us to get latest news and announcements