10 Reasons Why Tokenized Real Estate Could Be Africa's Next Big Investment Opportunity

Feb 12, 2025

10 Reasons Why Tokenized Real Estate Could Be Africa's Next Big Investment Opportunity

Feb 12, 2025

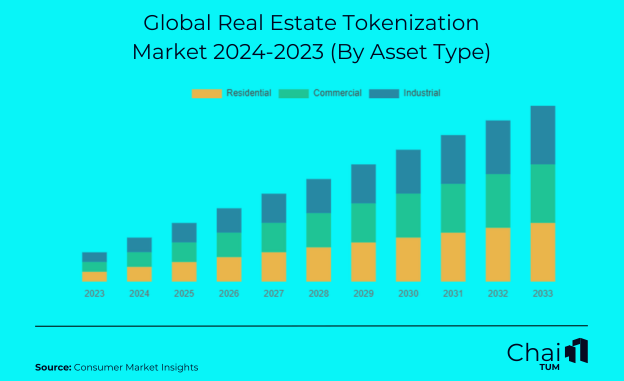

The global real estate tokenization market is on the brink of remarkable growth. New research by the CMI Team forecasts an impressive 21% CAGR from 2024 to 2033. The market, valued at $3.5 billion in 2024, is expected to soar to USD 19.4 billion by 2033. These projections reflect strong market interest and increasing adoption of blockchain in real estate.

Four years ago, the Central Bank of Nigeria launched a digital currency (eNaira)—a robust foundation for asset tokenization to flourish, particularly in light of the SEC’s regulatory framework for digital assets introduced in September 2020. Tokenization of real estate can help bridge the gap between the high demand and supply issues for affordable housing in Africa.

The increasing use of asset tokenization is bolstered by the rising number of smartphone users across Africa. Data from Statista indicates that the African smartphone market is expected to expand, reaching approximately 200.8 million units by 2029.

Here are 10 reasons why tokenization is king in Africa.

1. Fractional Ownership Will Unlock New Opportunities

All real estate investors always part with huge sums of money. If you are looking to buy entire properties, you’ll need substantial capital, but tokenization allows you to invest fractionally, lowering the financial barrier to entry.

Kenya is building a smart city, Konza Technopolis, which will be a hub for technology, innovation, and sustainable development. What’s the budget? The government has committed more than $1.5 billion. Pocket change? Certainly not. But with tokenization, everyone can own a piece of the city by investing fractionally in its infrastructure and real estate.

The good news is that platforms like RedSwan, Spydra, and AlphabloQ are already enabling this shift, significantly lowering the financial entry point into such investment opportunities. It means that more middle-class Africans and international investors will finally get the chance to put their money into high-value real estate projects.

2. It Will Increase Liquidity in Real Estate Markets

Real estate is one of the most illiquid investments out there. You cannot easily turn your property into cash at a moment’s notice. It takes time to sell, and finding ready buyers may be rather difficult.

However, digitizing property allows you to divide it into tokens that you can trade on secondary markets. At the highest levels, it transforms bricks and mortar into a fluid asset class.

This increased liquidity should boost investor confidence and encourage greater capital flow into the continent’s real estate sector.

3. African Cities Face Massive Housing Demands

The African continent is home to approximately 1.52 billion people, second only to Asia. Further, a past report indicated that by 2050 Africa will have accounted for the highest population growth, adding an extra 1.3 billion people to the world. This rapid population increase is behind the heightened urbanization being experienced in several African cities, which has in turn created a massive demand for housing.

Information shared by Invest Africa 54 shows that Kigali, for instance, needs 458,265 new units by the end of 2025. The real estate market in Lagos is projected to grow by 7.1% in the next 5 years, while Kenya needs to build as many as 200,000 new houses every year. Tokenization can help attract investors to fund these much-needed housing projects.

4. Institutional Adoption is Growing

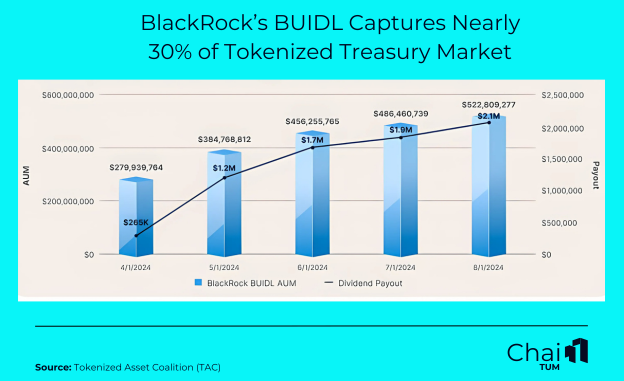

Global financial institutions are also beginning to recognize the potential of tokenized real-world assets (RWAs). Goldman Sachs, for instance, recently announced plans to launch three tokenization projects and marketplaces. Rival firm BlackRock already has a head start, with its Ethereum-based tokenization fund BUIDL now boasting more than half a billion dollars in assets under management.

The belief in the fledgling industry is so great that in 2024, the decentralized asset financing protocol, Centrifuge, co-founded the Tokenized Asset Coalition (TAC) to unite traditional and crypto financial systems to get them ready for when a majority of assets will be tokenized on-chain.

Elsewhere, analysts have predicted the value of tokenized RWAs could surpass $50 billion soon, and you can be sure that Africa, with its underdeveloped real estate financing ecosystem, will benefit from a fair bit of that money.

5. Regulatory Sandboxes Are Supporting Innovation

African governments and financial authorities have often been accused of stifling innovation. However, it feels like a modest breeze of change is gently wafting across the continent.

There’s no better example of this than Kenya’s Capital Markets Authority (CMA), which recently admitted AlphabloQ and Yeshara Tokens into its regulatory sandbox to test tokenized real estate platforms.

South Africa’s Financial Sector Conduct Authority (FSCA) is also working on clearer guidelines for digital asset-backed securities, something that could increase investor confidence and accelerate the adoption of tokenized real estate investment.

6. Tokenization Lowers the Barrier of Entry

Real estate’s segregated populism lets the best ideas bubble up as everyone constantly competes to reimagine space and value rather than ownership.

Tokenization will allow micro-investments, with regular folk hopefully able to buy tokens for anywhere between $10 and $50. Additionally, it will eliminate a bunch of expensive intermediaries that have traditionally been a part of the property buying process, including banks, lawyers, and brokers.

Finally, tokenization will allow peer-to-peer transactions through blockchain technology, with this level of democratization allowing millions of Africans to participate in a sector that was previously out of reach.

7. Transparency and Security

A sad facet of property investment on the continent is the corruption and inefficiency that accompanies it. In some countries, title deeds are not worth the paper they are printed on, with hapless investors routinely losing their assets to well-connected cartels.

This issue has put off many people who would have been willing to sink their money into real estate development.

First, blockchain is immutable, meaning property records cannot be altered or tampered with. Second, it is transparent, with ownership records publicly available for perusal and verification. That’s not all it does; tokenized transactions can help reduce the risk of forgery and disputes, making blockchain-powered real estate far more secure than traditional land registry systems.

8. Easier Cross-Border Investments

While there are several regional trading and economic blocs across the continent, property buying across borders is often complicated by legal, financial, and logistical challenges. This makes it hard for potential investors in one country to put money in a real estate project in another.

However, tokenization should help remove such barriers, allowing for seamless digital transactions across different jurisdictions. Companies like AfriCred are already building platforms to facilitate cross-border payments, secure tokenized property transactions, and international investor participation in the African real estate market. If they succeed, billions of dollars in global capital could flow into the region’s real estate sector, pushing it to greater heights.

9. Government and Private Sector Support is Growing

In 2024, several African governments and private enterprises launched initiatives to actively explore tokenized real estate. For example, in Nigeria, the Lagos State leadership announced plans to tokenize real estate to make property investment accessible.

In Kenya, a Cardano-backed project, Empowa.io, recently announced that it had received $600,000 in funding to facilitate real estate tokenization in the country.

Elsewhere in South Africa, some property companies are trying to improve the efficiency and transparency of the country’s land registry system by piloting blockchain-based solutions.

Such developments are a positive sign that those in authority are slowly recognizing the potential of blockchain to change property investment in Africa.

10. The Future of Finance is Tokenized

Remember TAC? We mentioned the coalition earlier. Well, in 2024, it reported that the total value locked (TVL) in tokenized assets had reached $186 billion. Essentially, this is the total monetary value of assets that have been put in decentralized finance (DeFi) platforms, and at the time, the eye-watering figure represented a 32% year-to-date increase in that particular metric.

Additionally, the Boston Consulting Group projects the value of RWAs to grow to as much as $600 billion by 2030. While some may consider the amount far-fetched, a survey by Primior revealed that 80% of high-net-worth individuals and 67% of institutions either already have funds tied in tokenized assets or are planning to invest in them.

The conclusion? Major financial institutions, governments, and private investors are backing the movement, and even if you don’t like it, you’re going to have to get used to it.

Stay informed on the latest in tokenization by subscribing to the Chaintum Newsletter. Discover how such technologies are transforming the future of real estate investment in Africa and beyond.

Subsribe To Our Newsletter

Get the Inaugural Edition of Chaintum Magazine Right at Your Inbox