Tokenized Real Estate in Africa: On the Brink of a Dubai-Style Boom?

Feb 24,2025

According to the World Bank, Africa’s cities are growing fast—3.8% growth annually, the highest in the world. By 2050, the continent will need over 50 million new homes. But there’s a problem. Barely 2%-5% of Africans can access mortgages.

What if there is a better way to offset the numerous real estate projects mushrooming in most African cities?

Real estate investors have long tracked housing starts, mortgage rates, and the Home Price Index (HPI) to gauge sectoral performance. But tokenized real estate has the potential to disrupt this reliance, potentially making these metrics irrelevant in the next five years.

Thanks to blockchain-enabled tokenization services, traditional real estate financing models are beginning to feel like the stranded assets they are: high in cost but utilized by only 10% of the African population.

Based on various studies [1] [2] [3], tokenization could increase real estate utilization, significantly activating stranded assets and boosting their ownership and liquidity. For example, St. Regis Aspen Resort tokenized its equity, raising $18 million in two years. This project demonstrated increased liquidity and accessibility for investors, with the token value growing by 30% within 18 months and trading strongly on secondary platforms like tZero.

Affordable housing looms as a significant challenge in Africa. Many individuals, who typically would buy homes after landing well-paying jobs, or properties after getting huge sums of money, are rethinking the economics of those decisions given the burst in alternative means of financing with the rise of a sharing economy.

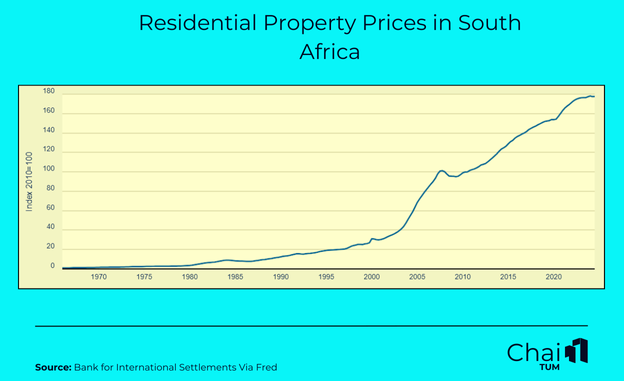

As the Graph 1 below illustrates, if urbanization in Africa continues to grow during the next five years and housing demand increases, residential property prices will continue skyrocketing in countries in South Africa where the housing price index was 3.85 in 1980 but 177.56 in 2024.

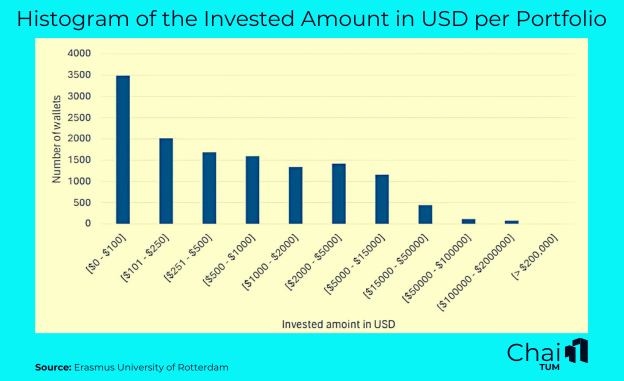

Real estate tokenization makes property investment more accessible through fractional ownership. For example, Graph 2 shows that 3,500 wallets hold $100 or less in RealIT tokens, while fewer than 500 wallets hold between $10,000 and $2,000,000. This model creates a more inclusive economy, especially for low-income Africans looking to invest in highly priced properties.

Graph 1

Graph 2

Fractionalized real estate (FRE) could push this trend into overdrive, especially with RedSwan’s push to tokenize African properties, building on its success of tokenizing nearly $5 billion in assets.

As is illustrated below, in 2023, the current cost to own the cheapest house built by a private developer varies per country: Tanzania ($80,000), South Africa ($34,501), Egypt ($13,981), Nigeria ($7,312), and Kenya ($7,111). For many people, land prices and availability of construction materials add regularly to these costs as shown in Figure 3 below.

Graph 3

While FREs still have at least a few years of technological and regulatory hurdles to jump. If they were to be widely implemented, they would be cost-competitive with higher utilization rates and far less expensive than traditional real estate assets.

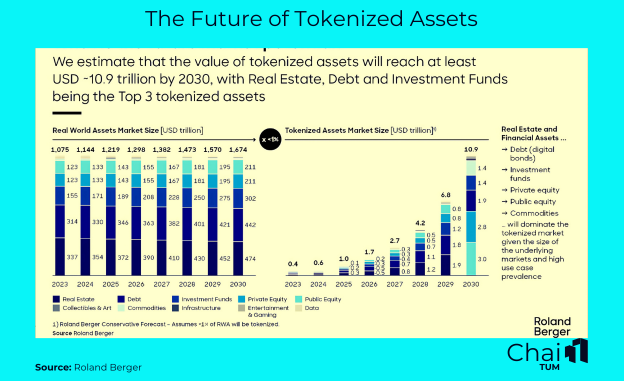

When more individual and institutional investors embrace them, FREs will become more compelling over time given their high accessibility and liquidity. By the end of the decade, tokenized assets will reach approximately 10.9 trillion, with real estate being among the top 3 assets as shown in the figure below.

Graph 4

Yet, cost reduction is just one of the benefits of FREs. Others, such low investment barriers and high transparency , would cement the case for RFEs if regulated better by African Governments.

Compliance is the most serious of adoption considerations. Kenya is taking small but steady steps. The government is piloting blockchain land registries, and while tokenized property investment isn’t fully regulated yet, the VASP Bill 2025 suggests change is coming. Meanwhile, AlphabloQ just got the green light to test its real estate tokenization model in the CMA sandbox. Nigeria is ahead of the game since the SEC’s digital asset guidelines provide a clear framework for real estate-backed tokens. South Africa isn’t far behind. With the FSB’s recognition of crypto-assets, security token offerings in real estate now have a legitimate path forward.

Consequently, many African countries may be swayed sooner than most analysts believe by arguments that RFEs could be the remedy for the stalled smart city and affordable housing problems. The value proposition here is clear, and it will become clearer as regulators pave the way and investors shift to RFEs.

FREs will Free Residential, Commercial and Municipal Real Estate for Higher Returns

Commercial, residential and municipal real estate require a lot of investment but with slow offsetting, a problem that RFEs will solve in large part. Here are a few examples to illustrate this:

- In Nigeria, Mixta Africa partnered with Twelve, a digital investment platform, to tokenize plots in Lagos New Town. Over two years, 25 investors pooled ₦168 million ($400,000), making real estate investment more accessible.

- Elsewhere, in January 2025, Estate Slice NFT linked up with LMCSWAP—the first blockchain-powered real estate exchange in Africa. Backed by a $50 billion infrastructure commitment, they’re fractionalizing property ownership across 15 African nations, with buy-ins starting at just $500.

- And in Angola, the African Megacities Initiative (AMCI) is on a mission. Founded in 2024, this non-profit is leveraging blockchain to democratize real estate investment, pushing for affordable housing solutions across sub-Saharan Africa.

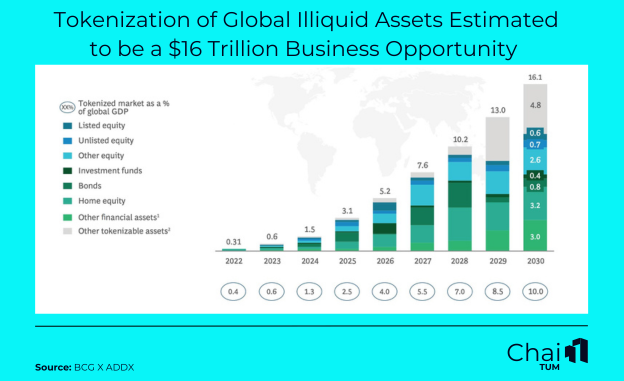

If RFEs were to replace 60% of illiquid real estate assets in Africa, they would free up properties worth roughly USD 9.54 trillion, contributing to the USD 16 trillion business opportunity forecast by 2030 as shown above. Repurposing financing models through tokenization would deliver significant incremental returns on invested capital. In a vibrant fractionalized ecosystem, African real estate investors will be able to invest in high-value properties, while homeowners might have more accessible and less costly financing. Traditional developers will have their properties being offset more quickly, ultimately turning to these new models completely. By Chaintum’s estimates, it should take less than 3 years for most cities to replicate Dubai’s tokenization success.

Graph 5

Why do we forecast this?

- Growthpoint (South Africa) launched e-CO₂, a blockchain-backed green energy initiative, in August 2024. The idea? Use blockchain to distribute renewable energy across ten properties in Sandton, Johannesburg.

- Konza Technopolis, Kenya’s Silicon Savannah, needs big funding to match its big vision, but government budgets are too slow. Cabinet Secretary in charge of Information, Communications & The Digital Economy, William Kabogo, proposed selling digital stakes to investors, raising capital quickly, and letting Konza grow at the speed of investment.

- A startup like AlphaBloQ is offering exclusive pre-market access to tokenized properties, from 127 Imela Place in Nairobi to Park Villas in Nigeria’s Lakowe Lakes Golf and Country Estate.

- The world’s biggest developers and top economies, such as the United States (US), Switzerland, United Arab Emirates, and India, are experimenting, and soon they will influence Africa.

Based on this analysis, Africa should double down on better regulatory frameworks for digital assets, encourage institutional and private sector buy-in, sandbox startups with real-word FRE solutions, and intensify pilot projects.

Subsribe To Our Newsletter

Get the Inaugural Edition of Chaintum Magazine Right at Your Inbox