Tokenized Real Estate: How RedSwan CRE is Reimagining Real Estate Investment

Feb 25,2025

The real estate industry in Africa, larger than the stock and bond markets combined, currently faces a number of critical headwinds. Following a period of record growth during the early 2020s, the COVID era saw widespread market slowdowns and project delays as development costs soared while investment waned. However, the market is projected to grow by 5.58% between 2025 and 2029, reaching a market volume of US$21.92 trillion by 2029.

Additionally, selling property is an increasingly prevalent challenge that is exacerbated by speculative investments, the proliferation of underutilized developments, market saturation, and consumer preference for flexible leasing models and mixed-use properties. Differentiating and capturing investor interest in today’s highly competitive market is more challenging than ever.

Despite these challenges, significant growth opportunities still exist. Gen Z and Gen Alpha, who have been immersed in the digital landscape from a young age, are reshaping market trends. — they are expected to be more receptive to new real estate investment models like tokenization.

Furthermore, Africa, a region of emerging markets once sidelined due to economic and infrastructure challenges, is now witnessing rapid real estate growth. Over the next decade, these markets present vast untapped potential, fueled by rising smartphone adoption, enhanced internet connectivity, and increasing household incomes.

The first section of this report delves into the shifting landscape of real estate investment, highlighting the challenges of attracting investors while identifying high-growth opportunities across Africa. The latter half focuses on RedSwan, a blockchain-driven tokenization platform redefining the relationship between developers and buyers. By analyzing industry leaders, we assess the potential of Web3 tokenization platforms and the evolving dynamics of value distribution in real estate.

Challenges With Selling

One of the biggest hurdles in the real estate industry today is selling a property. Shifting consumer preferences, evolving regulations, higher entry barriers, and an oversupply of high-cost properties have intensified competition, making it increasingly difficult to close sales.

Potential property investors typically spend the majority of their time researching market trends, comparing property values, securing financing, and navigating complex legal and regulatory requirements before making a purchase decision. In 2024, the leading real estate investment asset in Africa was residential property, with the sector valued at approximately US$14.87 trillion. Notably, 28% of property purchases in South Africa were made by investors, reflecting a strong demand for investment properties. Despite a surge in high-value developments across the continent, only 12% of these properties were acquired by local buyers, indicating a significant portion being purchased by foreign investors.

Mortgages have traditionally been one of the more sophisticated property financing models for Africans. The rise of Savings and Credit Cooperative Organizations (SACCOs) and bank home loans, combined with the proliferation of housing microfinance institutions, has enabled many Africans to acquire homes and buildings. However, in 2021, significant changes in digital marketing strategies and the adoption of property technology (PropTech) transformed how developers reach their target audiences.

While these shifts didn’t eliminate the role of real estate agents, they significantly altered how properties are marketed and financed. Developers and agents have adapted by leveraging digital platforms to expand their reach, but the landscape now favors those with substantial resources, leaving smaller firms facing an uphill battle.

Looking ahead, significant improvements in the real estate landscape seem uncertain. However, blockchain technology is set to streamline property fractionalization, making the process more efficient. Additionally, it will lower entry barriers and enhance market liquidity, creating new opportunities for investors. Real estate tokenization platforms like AlphabloQ and Empowa have emerged as viable alternatives for tech-savvy developers, already attracting interest from investors seeking more accessible and liquid property investment opportunities.

This brings us to the traditional real estate market, where property owners face a series of additional hurdles they must overcome. They must navigate complex land tenure systems, secure clear property rights, and comply with evolving regulatory frameworks. Cross-border property investment is also outright forbidden in some key markets, such as Nigeria and Egypt.

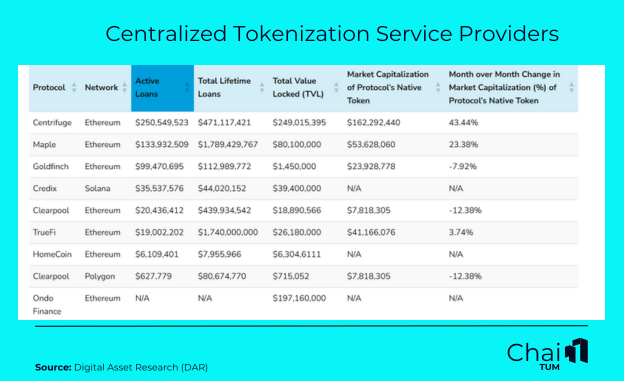

However, tokenized real estate remains a niche within the broader industry, with RealT having an estimated 7,500 unique active wallet accounts interacting with over 200 on-chain properties in the United States. It’s important to note that these metrics do not account for inactive or dormant wallets, of which there are many, or the fact that only roughly a quarter of these protocols have more than a 10% change in market cap for their native token, as shown in Graph 1 below.

Graph 1

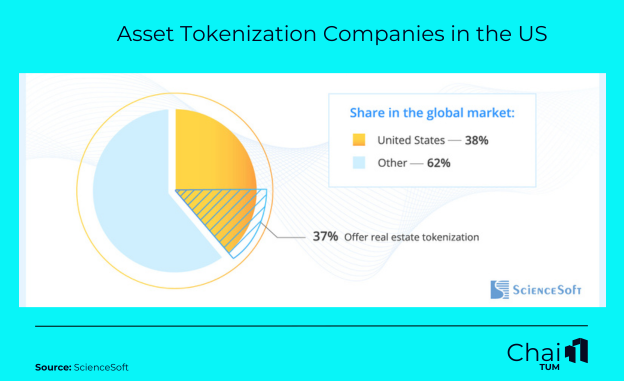

The difficulties within this niche market have been further intensified by the rapid surge in new platforms and tokenized assets introduced in recent years. Despite the number of new real estate tokens increasing significantly since 2023, when Roland Berger evaluated the market at $119 billion, the majority (38%) of tokenization service companies are registered in the US as shown in Graph 2. In 2024 alone, numerous new networks and ecosystems were announced alongside just a handful of new properties being tokenized.

The main challenge is that most of these new networks have struggled to attract and retain token holders. As a result, tokenization platforms are constantly competing for liquidity. With an increasingly saturated market, emerging projects are vying for the same limited group of investors, yet few viable strategies exist to help them expand beyond this niche and achieve meaningful growth.

Amid these challenges, a new wave of Web3 companies is developing blockchain-based tokenization models. By leveraging innovative incentive structures and decentralized governance mechanisms, these companies are finding ways to gain a competitive edge through Web3 integration.

One Web3 company—Redswan CRE—has successfully achieved product-market fit in emerging economies. Rather than competing in overcrowded tier-one markets dominated by traditional Web2 firms, it is tapping into the vast potential of underserved regions. By utilizing blockchain’s borderless payment infrastructure, the company is unlocking new opportunities and expanding access to real estate investment on a global scale.

Graph 2

How is RedSwan Shaping the Future of Tokenized Real Estate?

Redswan is a blockchain-powered platform that leverages on-chain and off-chain data, to create tokens by representing equity limited partnership shares of Class A and B CRE properties on the blockchain. They enable investors to purchase parts of properties with lower minimum investment thresholds (as low as $1,000). Unlike localized platforms, RedSwan operates a marketplace where accredited U.S. investors (under Regulation D) and international investors (under Regulation S) can access these tokenized CRE opportunities.

At the core of the platform lies a token studio running on the Hedera network. The network leverages the Hashgraph consensus algorithm, which provides asynchronous Byzantine Fault Tolerance (aBFT) for secure, high-throughput, and low-latency transactions.

RedSwan utilizes the Hedera Token Service (HTS) to implement on-chain compliance measures such as optional Know Your Customer (KYC) verification, Anti-Money Laundering (AML) protocols, and enforceable royalty mechanisms. These features enable the issuance of tokenized securities while allowing the platform to adapt to evolving regulatory frameworks.

Additionally, RedSwan leverages the Hedera Smart Contract Service (HSCS), which is Ethereum Virtual Machine (EVM)-compatible, to create ERC-20-compliant digital securities. The underlying token standard for compliant security tokenization is open-source and accessible to the Hedera developer community via GitHub.

The platform facilitates transactions in both USD and hUSDC, a version of the USDC stablecoin issued by Circle on Hedera’s network. By leveraging these capabilities, users can engage in the creation, issuance, and investment of digital asset-backed securities.

Growth in Africa

RedSwan’s largest market by far is the US due to the company’s origins and its strong presence across North America, particularly in commercial real estate. That said, Africa is also a viable market, as RedSwan has launched RedSwan CRE Africa to attract foreign direct investment into the continent’s real estate sector.

“We want to make it possible for anyone to invest in institutional-grade properties that were previously out of reach,” Edward Nwokedi, the co-founder of Redswan CRE, said. “By developing a platform that is capable of tokenizing these assets, we’re not just changing how people invest in real estate—we’re transforming the entire market.”

To replicate the success seen in the Global North, the company has decided to take a less similar systemic approach to growth in Africa. Eliminating the complexities of cross-border transactions has enabled RedSwan CRE Africa to streamline the process while making Africa’s real estate assets accessible to international investors. .

For example, RedSwan CRE Nigeria has introduced its Core and Value-Add Funds, each valued at $800 million, allowing investors to access premium commercial real estate in the U.S. and key African cities. These tokenized funds offer fractional ownership starting at $100, with a 1.5% annual management fee. Investments span office, retail, industrial, corporate residential, student housing, and specialty assets, managed by a Registered Investment Advisory team.

“We’re really interested in Africa. We think that’s an untapped market, and we think that the tokenization industry can start building wealth and adding value to people’s lives,” Nwokedi said in a past interview with online blockchain publication Mariblock. “Blockchain is on a whole different level that people can’t grab to cheat or disrupt,” he added.

RedSwan must demonstrate its ability to sustain growth beyond market entry while establishing itself as the leading compliant tokenization platform across the continent. A crucial aspect of its strategy is enabling “expressions of interest,” allowing potential investors to indicate interest in properties before they are officially listed. To stay competitive, the company must enhance its tokenization framework by integrating compliant peer-to-peer trading and secure institutional custody solutions. At the same time, expanding AI-driven analytics and data tools will be key to ensuring long-term market relevance.

If you’re interested in learning more about similar initiatives or exploring other opportunities in the blockchain and crypto space, subscribe to the Chaintum newsletter or connect with our expanding community on X and LinkedIn.

Subsribe To Our Newsletter

Get the Inaugural Edition of Chaintum Magazine Right at Your Inbox