The Rise of Small-Scale Bitcoin Mining in Africa: Exploring the Decentralization of Mining Pools

Subheading: We analyze the growing trend of small-scale Bitcoin mining in Africa, highlighting its impact on financial inclusion, energy utilization, and economic opportunities.

March 7. 2025

Summary

- Bitcoin mining is no longer dominated by industrial-scale operations—African miners are proving that small-scale setups can be both profitable and sustainable.

- High electricity costs and infrastructure challenges remain key barriers, but innovations in renewable energy and mining pools are enabling more individuals to participate.

- Innovative models like Gridless Compute are proving Bitcoin mining can sustainably fund microgrids, with 18% of Ethiopia’s monthly power sales now tied to mining.

- This report explores key trends, case studies, and regulatory perspectives shaping Africa’s emerging small-scale mining sector.

Introduction

Bitcoin mining in Africa has grown from scrappy upstarts to a model that incentivizes some of the most underprivileged populations. Despite high energy costs, unstable regulatory environments, and limited access to mining equipment, small-scale miners are embracing renewable energy solutions, mining pools, and mobile-first financial models to stay competitive.

To understand how this space is evolving and performing, Chaintum researched small-scale mining potential across three user categories:

- Independent miners using off-grid hydro, wind, and solar power, often in rural areas. These miners leverage solar panels to reduce electricity costs and mine profitably without relying on unstable national grids.

- Cooperative mining groups pool resources, particularly the Green Africa Mining Alliance (GAMA), which connects small-scale miners across Kenya, Nigeria, and Ghana to share ASIC hardware, optimize energy costs, and collectively participate in decentralized mining pools.

- Government-backed and NGO-supported initiatives, such as Ethiopia’s partnership with private mining firms to harness excess hydropower from the Grand Renaissance Dam to support Bitcoin mining while stabilizing energy distribution.

The results revealed some interesting insights, especially for investors assessing Africa’s mining market, policymakers considering regulatory frameworks, and energy companies exploring sustainable mining models.

Independent Miners using Off-Grid Power

Independent small-scale miners in Africa have gained unparalleled exposure to alternative energy solutions, decentralized finance (DeFi) integration, and community-driven mining pools. As most evidenced, in 2024, Africa’s Bitcoin mining sector is part of the global $1.92B market projected to reach $7B by 2032. Yet this growth diverges sharply from traditional mining hubs: over 90% of operations leverage stranded renewables like hydro, geothermal, and solar.

The availability of stranded power partly explains the surge in localized mining clusters, particularly in East Africa, where Ethiopia’s Grand Renaissance Dam and Kenya’s Olkaria geothermal plants offer surplus electricity at competitive rates. Even after some countries adopted energy nationalism due to mining crowding out households (e.g., Angola’s 2024 ban on Bitcoin mining to prioritize residential energy consumption), small-scale miners have adapted by migrating operations to regions with underutilized power grids to form mobile mining units and integrating off-grid renewables.

For example, when Trojan was just starting out, its founder, Siyanbola, moved to a northern Nigeria community, where there was excess and free hydroelectric power. They developed a shed model of Bitcoin mining and moved its miners close to the substation to tap the power directly.

“We only had to rent a house to become part of the community [access free power] and start mining,” said Siyanbola.

Gridless operations have also proven that small-scale bitcoin data centers and renewables-based mini-grids close the gap between perceived risks and the risk/return expectations of investors, aligning the incentives of financiers, multilateral organizations and local communities in remote regions.

With 43% of Sub-Saharan Africans lacking electricity access (World Bank, 2023), miners are solving two problems at once—monetizing excess green energy while expanding power infrastructure.

Cooperative Mining Groups

Cooperative mining groups are also the dominant platform for small-scale miners, but the scale of their operations is significantly smaller than that of large industrial mining firms. While prominent companies such as GAMA help small-scale miners access discounted mining equipment and technical support, they still face challenges in scaling due to limited capital and regulatory uncertainty. Additionally, GAMA has a seed program that offers vetted applicants a heavily discounted entry into Bitcoin mining, starting with five tested ASICs and potential access to ten more after proving hashrate for three months, with shipping and clearing costs covered by the miner.

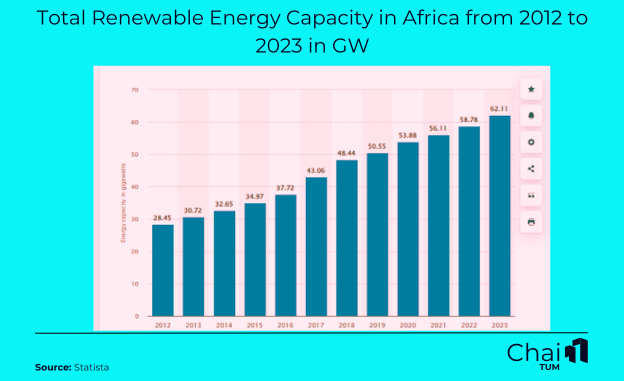

Community-centric mining groups have much less penetration in Africa since access to mining capital and infrastructure remains highly centralized. Despite Africa’s enormous stranded renewable energy potential—estimated at over 62 GW from hydro, solar, and geothermal sources (Graph 1)—only a few hundred individuals are engaged in formalized cooperative mining structures. In fact, there might be a lack of awareness about such communities. The primary reason is that miners fear exposing their activities could put them at risk of government crackdowns or increased taxation, particularly in countries like Ghana and South Africa, where crypto regulations remain ambiguous. Interestingly, GAMA has defied all the odds, punching above its weight in the cooperative category by establishing transparent mining pools, advocating for policy clarity, and leveraging renewable energy partnerships to sustain small-scale mining operations.

Graph 1

Government-Backed and NGO-supported Initiatives

Governments and NGOs both play important roles in promoting small-scale Bitcoin mining, though their approaches differ in scope and implementation. The former is well-positioned for establishing regulatory frameworks and directing energy infrastructure investments, while their latter counterpart excels at fostering sustainable development models and community-focused energy access initiatives.

National energy authorities can maximize the potential of the generated electricity to invite foreign direct investment and public-private partnerships that expand grid capacity. For example, Ethiopia signed power supply agreements with 25 Bitcoin mining firms, generating $55 million in revenue over 10 months, while Kenya’s Kengen has created a Special Economic Zone [Olkaria] that offers low-cost renewable energy and tax breaks to data centers. Thus, companies like Bitcluster and Bitmain have rushed to Ethiopia to capitalize on hydropower rates as low as $0.03/kWh from the Grand Ethiopian Renaissance Dam and duty-free equipment import policies.

The marketing and business development director of Ethiopian Electric Power (EEP), Hiwot Eshetu, stated that “Bitcoin miners invest billions into our energy infrastructure. Their demand lets us monetize excess dam output while building transmission lines for future industrial use.”

Besides, nonprofit initiatives like the Bitcoin Mining Hub Namibia have also been crucial in lobbying policymakers and stakeholders to create better incentives for small-scale miners to utilize the vast local wind and solar energy. They act as the first touchpoint for individuals who don’t know where to start while providing educational resources, technical assistance, and connections to cooperative mining groups.

Governments appear to have a preferential treatment for large-scale miners while small-scale miners struggle with regulatory uncertainty, limited access to capital, and high entry costs. They often face bureaucratic hurdles, such as licensing restrictions, complex tax structures, and intermittent crackdowns on informal mining operations. They aim to attract foreign direct investment and maximize tax revenues from well-established mining firms, which are easier to regulate and integrate into national economic strategies.

However, NGO-centric formations gravitate toward more authentic community co-ownership models, exemplified by Kenya’s Gridless Compute reducing electricity costs for 500 families through hydro-powered mining microgrids.

Africa’s Bitcoin mining hash rate surged to 3% of global activity in 2024, led by Ethiopia’s renewable-powered operations contributing 2.5% alone. Chaintum predicts that by 2026, Africa’s hash rate share will reach 6-8%, driven by Ethiopia’s expansion and increased miner activities in Kenya, Malawi, Nigeria, Zambia, and the Democratic Republic of Congo (DRC). Besides, modular nuclear reactors (e.g., Rwanda’s 2025 deal with Rolls-Royce) could pair with mining to accelerate electrification.

As Bitcoin mining continues to be Africa’s fastest-growing energy offtaker by turning stranded renewables into economic assets, small-scale models can outperform industrial farms in community impact and grid stability.

Want to stay ahead of the curve and learn more about this groundbreaking innovation? Subscribe to our newsletter and follow us on X and LinkedIn to join the conversation and be part of the future of real estate in Africa.

Subsribe To Our Newsletter

Get the Inaugural Edition of Chaintum Magazine Right at Your Inbox