Avalanche L1s and the Appchain Thesis: A New Internet of Value?

The Etna Epoch — Lowering the Barrier to Sovereignty

June 18, 2025

Based on data from Avalanche’s recent Etna upgrade, it is clear that the technical and economic assumptions surrounding Layer 1 blockchain deployment have been fundamentally challenged. Previously, launching a sovereign chain was costly, technically intensive, and carried performance trade-offs that kept most application teams on shared Layer 1s. With Etna, however, Avalanche introduces a shift in this calculus, offering developers the ability to deploy sovereign blockchains for approximately 1.3 AVAX per validator monthly [1]. This drop in cost is not merely symbolic — it represents a pivotal moment where application-specific chains (or “appchains”) are no longer the privilege of VC-backed unicorns, but a plausible strategic option for any serious developer.

While modular chains such as Cosmos or Polkadot have long promised this vision, the complexity of deploying and maintaining them — from selecting consensus mechanisms to managing validator incentives — has hampered widespread adoption [2]. Avalanche addresses these friction points directly. Developers are given full sovereignty over consensus, validator requirements, fee models, and execution logic, without sacrificing interoperability with the broader Avalanche ecosystem. In essence, Etna has done for blockchain deployment what Shopify did for ecommerce — made it accessible, customizable, and streamlined.

Yet, it remains to be seen whether this ease of deployment will automatically translate into long-term ecosystem stickiness. The risks of fragmentation, duplicated effort, and low-utility chains persist, especially if interoperability tools are underutilized or ecosystem incentives aren’t properly aligned. Still, Etna opens the floodgates. And based on early adoption trends, it’s not just DeFi-native developers taking notice.

Appchains in the Wild — From Fantasy Worlds to Vehicle Titles

Consider the case of MapleStory Universe, Nexon’s billion-dollar gaming franchise. Their newly launched Henesys chain — built as a permissioned Avalanche L1 — introduces gasless transactions and custom logic tailor-made for game mechanics [3]. The shift here is subtle but seismic: rather than building on top of a general-purpose chain and making performance compromises, developers can now build Layer 1s around the unique demands of their application. Gaming, where lag and transaction costs can kill user experience, becomes a natural frontier for this model.

Traditional enterprises are also beginning to test the waters. Bergen County, New Jersey, announced plans to tokenize over $240 billion in property deeds using their own Avalanche L1 [4]. Similarly, California’s DMV is digitizing 42 million vehicle titles through the same architecture [5]. Even JPMorgan, typically reticent to associate publicly with permissionless chains, is experimenting with tokenized fund operations on Avalanche’s permissioned L1s [6].

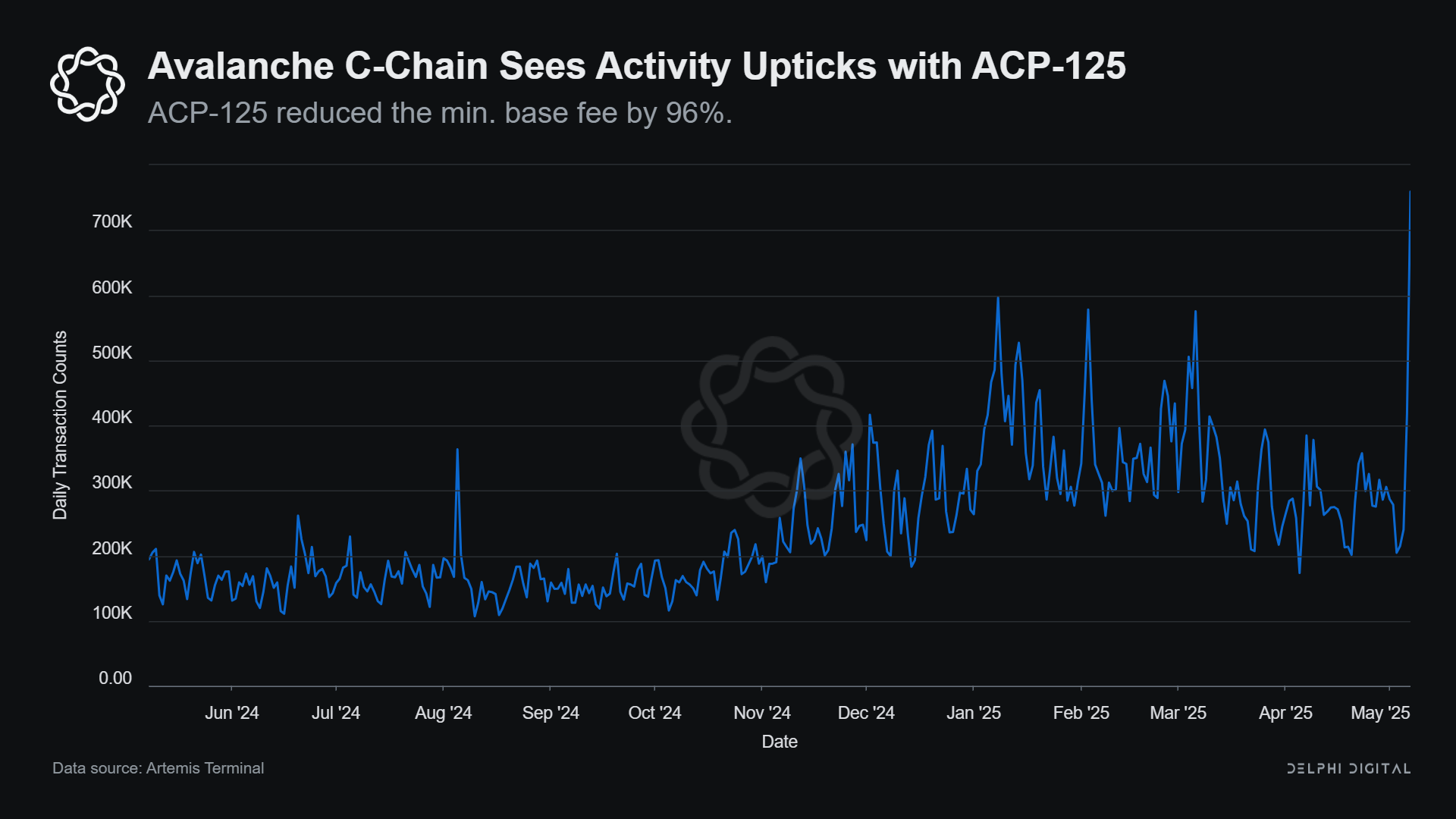

Consequently, the implications of Avalanche’s architecture go beyond novelty. We are seeing a convergence of sovereign digital infrastructure and enterprise-grade reliability. As Avalanche-native L1s become more prevalent, the historical tradeoff between blockchain sovereignty and composability may no longer hold. Already, daily transactions across Avalanche L1s have crossed the 13 million mark — a new all-time high. Monthly active addresses surged by 145% in May, and TVL increased by 13.5% to hit $1.5 billion since January [7]. Even L1 transaction fees have been reduced by a staggering 96%, reshaping the economics of blockchain interaction [8] as shown in Graph 1.

Graph 1

Yet, the question persists: can Avalanche maintain decentralization and network cohesion amid this sovereignty explosion? The appchain thesis, while elegant in theory, can quickly devolve into siloed ecosystems, requiring complex bridging solutions that undercut user experience. Whether Avalanche’s native interoperability architecture can avoid this fate will be central to its long-term relevance.

Battle Passes, Shuttered Games, and the Race for Culture

The growing adoption of Avalanche L1s has not gone unnoticed in the gaming and cultural sectors. In July, Avalanche launched a free-to-mint Battle Pass NFT, in partnership with Playfull and Magic Eden, allowing users to earn in-game assets and token rewards across 12 partner games [9]. While modest in AVAX terms (a mint fee of 0.053 AVAX or ~$1), the initiative has already seen over 2,000 users mint the pass. These reward loops represent early experiments in loyalty systems that link gameplay with economic incentives — perhaps hinting at what user acquisition might look like in web3-native gaming.

Still, optimism must be tempered with realism. Raini: The Lords of Light, once a flagship Avalanche-based TCG with over $1 million in player rewards, is shutting down this July due to low engagement [10]. This should serve as a cautionary tale: infrastructure solves one half of the problem, but compelling content and community flywheels are needed to sustain it.

Even so, the cultural momentum is clearly tilting toward Avalanche. In Kenya, Team1 Gaming hosted the NaiGaming Connect event on July 5th at SmartVR, TRM. This high-energy gathering of game developers, players, and creators highlighted the increasing importance of local cultural hubs in blockchain gaming adoption. It is no longer enough to ship code — teams must ship culture.

Despite widespread optimism about the power of Avalanche L1s, deeper concerns remain around validator incentives, long-term sustainability, and potential centralization vectors. However, if Avalanche can iterate fast, improve its onboarding pipelines, and continue bridging web2 institutions with web3-native tooling, it could well cement itself as the backbone of appchain deployment.

Conclusion: The L1 Operating System of the Internet?

Avalanche’s Etna upgrade might be viewed in retrospect as a turning point — not only for its architecture but for the broader appchain thesis. By removing the complexity tax and offering a genuinely sovereign yet composable platform, Avalanche has carved a unique space for itself in the increasingly crowded L1 landscape. It is now possible to imagine a future where every serious application — from games to logistics to government registries — launches its own Avalanche L1, optimized for its unique requirements, yet natively interoperable with a broader value web.

If so, we may need to rethink what a “Layer 1” actually is. Rather than a singular monolith, it could be a flexible operating system — a mesh of sovereign but interconnected chains — with Avalanche as its kernel. Whether that vision materializes will depend not just on code, but on coordination, credibility, and community.

Until then, the numbers, narratives, and next steps will continue unfolding — one sovereign chain at a time.

References

[1] Avax Network. 2025. “Avax.network — Etna: Enhancing the Sovereignty of Avalanche L1 Networks.” Avax.network — Etna: Enhancing the Sovereignty of Avalanche L1 Networks. 2025. https://www.avax.network/about/blog/etna-enhancing-the-sovereignty-of-avalanche-l1-networks.

[2] Anglen, Jesse. 2024. “Deciphering Blockchain Titans: Cosmos vs. Polkadot.” Rapidinnovation.io. Rapid Innovation. September 19, 2024. https://www.rapidinnovation.io/post/deciphering-blockchain-titans-cosmos-vs-polkadot.

[3] Dragan. 2024. “MapleStory Universe Launches Henesys Chain on Avalanche | PlayToEarn.” PlayToEarn. 2024. https://playtoearn.com/news/maplestory-universe-launches-henesys-chain-on-avalanche.

[4] Sandor, Krisztian. 2025. “RWA, AVAX News: A New Jersey County to Tokenize $240B Property Records on Avalanche.” CoinDesk. May 28, 2025. https://www.coindesk.com/business/2025/05/28/new-jerseys-bergen-county-to-tokenize-240b-in-real-estate-deeds-on-avalanche-network.

[5] Ostroff, Ethan G. 2024. “From Paper to Digital: The California DMV’s Leap into Blockchain Technology.” Consumer Financial Services Law Monitor. August 20, 2024. https://www.consumerfinancialserviceslawmonitor.com/2024/08/from-paper-to-digital-the-california-dmvs-leap-into-blockchain-technology/.

[6] Kinexys. 2023. “Project Guardian: Asset Tokenization | Kinexys by J.P. Morgan.” Kinexys by J.P. Morgan. 2023. https://www.jpmorgan.com/kinexys/content-hub/project-guardian.

[7] Coin World. 2025. “Avalanche Surpasses 1 Million Daily Transactions Marking Record On-Chain Boom.” Ainvest. June 20, 2025. https://www.ainvest.com/news/avalanche-surpasses-1-million-daily-transactions-marking-record-chain-boom-2506/.

[8] Thakur, Sahil. 2025. “Avalanche Sees Transaction Surge as Gas Fees Collapse after Etna and Octane Upgrades.” Our Crypto Talk. June 30, 2025. https://web.ourcryptotalk.com/news/avalanche-sees-ath-transactions.

[9] Ming, Akira. 2024. “Avalanche Battle Pass Goes Live with Free NFT and AVAX Token Rewards | PlayToEarn.” PlayToEarn. 2024. https://playtoearn.com/news/avalanche-battle-pass-goes-live-with-free-nft-and-avax-token-rewards.

[10] decrypt.co. 2025. “Avalanche Crypto Game ‘Raini: The Lords of Light’ Is Shutting Down.” Cryptonews.net. June 26, 2025. https://cryptonews.net/news/gamefi/31178527/.

Want to stay ahead of the curve and learn more about this groundbreaking innovation? Subscribe to our newsletter and follow us on X and LinkedIn to join the conversation and be part of the future of real estate in Africa.

Subsribe To Our Newsletter

Get the Inaugural Edition of Chaintum Magazine Right at Your Inbox