Nov 25, 2024

DeFi Adoption Challenges in Africa: Seeing Web3 through the Hurdles

It’s true what they say: the best things in life never come easy.

Decentralized Finance (DeFi) holds the potential to be a game-changer for Africa’s economy, yet its adoption has been slower than anticipated.

Cryptocurrencies and blockchain technology have faced a lot of uncertainty in Africa, mainly because most people don’t understand the technology or how it works. DeFi adoption in Africa is hurdled by a number of factors including stringent regulations, lack of technological awareness and limited infrastructure. Mention crypto, and the first thought that often comes to mind is either a scam or a tool for one.

Blockchain and Financial Inclusion

Access to Banking for the Unbanked

More than 70% of the population in Africa lacks access to traditional payment services like banks. In many parts of Africa, it’s common for people without access to banks to rely on “mattress banking”—storing money and valuables at home, often tucked away under the mattress. Here, blockchain solutions can fill this gap.

If Africa nailed one thing, it’s mobile money services—the seamless ability to send and receive money through a mobile phone. Africa is the leading continent, accounting for over 45% of all mobile money transactions in the world. In Kenya alone, 70% of all transactions are digital and more than 90% of the adult population has access to mobile money services known as M-Pesa. M-Pesa allows users to send and receive money to Safaricom registered sim cards from anywhere in Kenya. The service facilitates a large number of transactions in almost every sector of the Kenyan economy. And the best part is, you don’t need a smartphone for it. Users can easily access M-Pesa on feature phones too using Unstructured Supplementary Service Data (USSD).

“M-Pesa could have been a great ally of crypto if those running it did not see it as a competitor and, therefore, shouldn’t be enabled to grow.” wrote Nyairo in an opinion piece on Medium.

Nigeria is among African countries with the highest blockchain adoption rate. More than 47% of Nigerians reportedly use cryptocurrencies, one of the highest rates in the world. The country is ranked 2nd in the 2024 Top 20 Global Crypto Adoption index by Chainalysis.

Other African countries that are gradually adopting cryptocurrencies include Kenya, Tanzania, South Africa and Ghana. Some blockchain African startups include Kenya’s BitPesa and Bitsoko, South Africa’s Luno, Ice3X, GeoPay, BitSure and Chankura, and Ghana’s bitcoin exchange BTCGhana.

In South Africa, top banks in collaboration with other financial institutions launched Africa’s first ever private Ethereum-based smart contract to test the technology for future implementations. So, blockchain isn’t an entirely alien concept in Africa.

DeFi can easily leverage pre-existing mobile money systems in Africa to create an alternative to traditional banking, cross-border payment and remittances. This should reach the previously unbanked population.

Benefits of DeFi in Africa

Lower Transaction Costs

Decentralized finance is cheaper than traditional banking since it eliminates the need for intermediaries or middlemen. DeFi transactions are peer-to-peer (p2p) where users transact directly with each other without a central authority. And since there are no intermediates, transactions are cheaper, faster and more efficient. Better still, some blockchains have zero fees and allow users to transact for free.

Financial Inclusion and Autonomy

Decentralized finance is accessible to anyone regardless of where they are in the world. This promotes financial inclusion as people without access to banks can access similar services using blockchain. Moreover, since there is no intermediary, users have more control over their money.

Transparency and Security

Transactions in DeFi are recorded in public ledgers which cannot be altered. Blockchain stores data in blocks which are linked together in a chain. This enhances the security and transparency of a blockchain. Besides, all financial transactions on the blockchain are audited and verified, before adding them to the block. This ensures accountability and eliminates chances of corruption.

Challenges of DeFi in Africa

Regulatory Uncertainty

Regulatory uncertainty is the biggest threat to blockchain adoption all over the world and Africa is no exception. Given that decentralized finance is relatively novel in the world, there aren’t any clear regulations or legal frameworks around it. Different regulatory bodies in various countries have differing guidelines regarding the use of cryptocurrencies.

Africa’s rapid crypto adoption has prompted governments to tighten regulations or even ban cryptocurrencies altogether, citing concerns over financial stability and user protection. There is a concern that cryptocurrencies can be used for money laundering, tax evasion, fraud and other illicit activities, due to its anonymous nature. Crypto transactions can only be traced up to the wallet addresses. Linking addresses to personal identities is challenging unless the address owner or entities like exchanges disclose the information.

Africa has great potential to be a huge crypto hub, but many countries have banned the use of cryptocurrencies including Ghana, Egypt, Tanzania, Algeria, Republic of Congo, Tunisia, Sierra Leone, Morocco, Lesotho, and Cameroon.

All these countries have explicitly banned the use of cryptocurrencies. The Central Bank of Tunisia, for instance, outlawed the use of cryptocurrencies in 2018, and sanctioned a number of digital assets.

In 2019, Sierra Leone’s central bank prohibited two crypto firms from operating in the country and refused to give licenses to businesses and financial institutions dealing in cryptocurrency.

In Egypt, cryptocurrencies are banned by religious decree since trading cryptocurrency is prohibited under Islamic Law.

Technological Infrastructure

Blockchain technology heavily relies on internet connectivity. This is because blockchain involves node communication, data transmission and the use of smart contracts which can only occur through the internet.

As of January 2024, only 37% of African countries were connected to the internet compared to other continents such as Europe (91%) and Asia (70%).

Access to reliable internet connectivity poses a challenge to crypto adoption in Africa.

Digital Literacy

Even if people have access to the internet, some level of digital literacy is required to understand and use blockchain technology. Africa has the slowest rate of digitalization globally according to the World Bank. Low levels of digital literacy rate hinder blockchain adoption, since the industry itself is complex even for those who have a basic level of digital literacy.

Imagine explaining to a 60-year old senior citizen who has barely been exposed to technology, how Bitcoin works and why it is better than M-Pesa or MoMo? A research done in Kenya in 2014 showed that one of the biggest challenges facing crypto adoption in the country is the complexity of blockchain technology.

Scalability and Interoperability

DeFi and blockchains technology is still a relatively new concept and new challenges emerge everyday. The most common is issues of scalability and interoperability.

The Ethereum blockchain, for instance, has a high volume of activity and network congestion, which leads to slower transactions and high fees. There are about a million transactions processed on Ethereum in a day. This is twice as much as the Bitcoin blockchain.

Interoperability, on the other hand, is the ability of blockchains to interact with each other. With interoperability, users can access assets and services from other blockchains without having to switch networks or use multiple wallets. Not all blockchains are interoperable due to factors such as different consensus mechanisms or smart contract languages. This becomes a challenge to users who would want to send cryptocurrencies freely from one blockchain to another.

These issues make blockchain adoption much harder, especially in Africa where there is little digital and financial literacy.

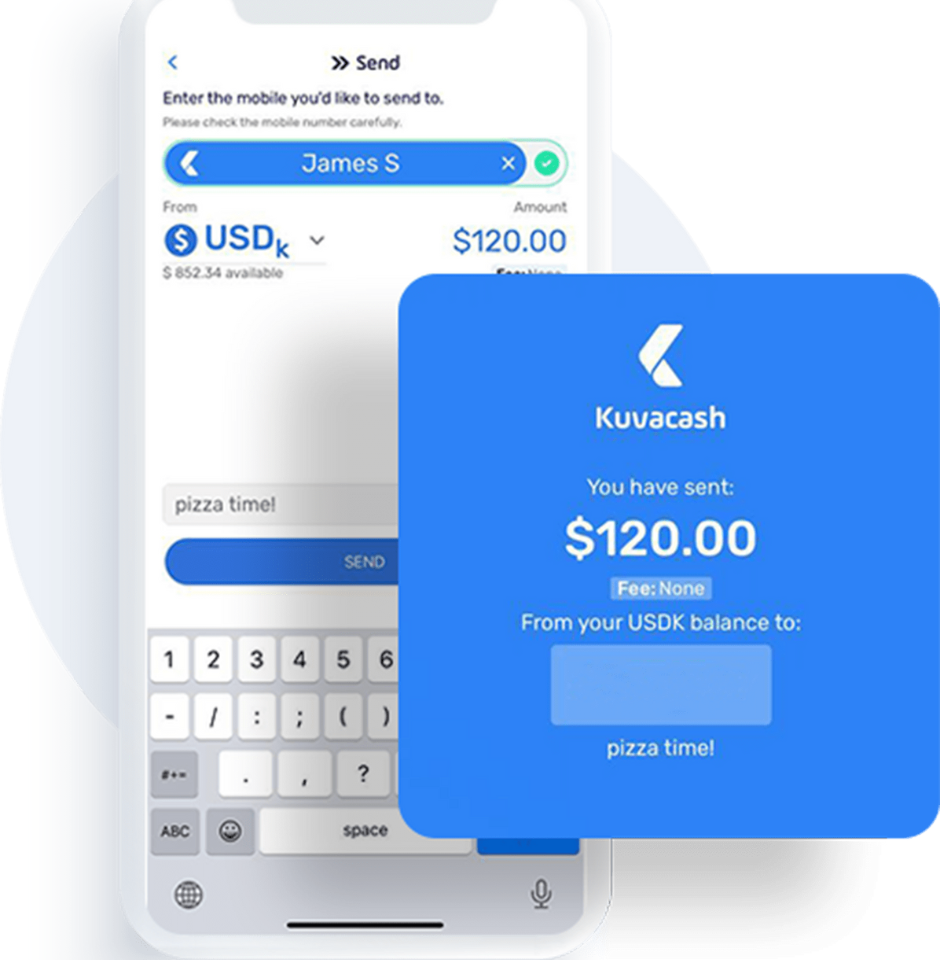

Photos on azafinance.com and kuva.com

Case Studies

Successful DeFi Project in Africa

BitPesa (AZA Finance - Kenya)

BitPesa is one of the successful DeFi projects in Kenya, founded in 2013. The company was the first to establish a market connecting cryptocurrencies with fiat money.It was later rebranded to AZA Finance in 2019.

BitPesa allows users to send money in the form of Bitcoin to African countries, including Kenya, Nigeria, Tanzania, Uganda, Ghana, Morocco, Senegal and the Democratic Republic of Congo. Digital currency sent is converted to the local currency of the recipient. For instance, a Kenyan sending money to Nigeria will transact BTC which will then be converted to Nigerian Naira.

Since its inception, BitPesa has transacted $1billion in volume across Africa and has seen a 300% transaction growth following its acquisition of TransferZero (Spanish fintech startup) and the launch of BFX (a B2B product).

BitPesa is also licensed by the Federal Conduct Authority (FCA) of the United Kingdom and Bank of Spain.

However, BitPesa was involved in a legal dispute with M-Pesa, where it was denied access to the platform and consequently shifted its operations from Kenya to Nigeria and Ghana markets.

Lessons Learnt

BitPesa leveraged Bitcoin’s low transaction fees to build a successful remittance business in Africa to offer a cost-effective solution for users and businesses. The cost of transactions on Bitpesa ranges between 1-3%. This shows that tackling pain points like high remittance costs is a powerful strategy for success in the fintech industry. The success of BitPesa suggests that DeFi projects in Africa should focus on use cases where they offer benefits over existing solutions.

Unsuccessful DeFi Project in Africa

Kuvacash (Zimbabwe)

Kuvacash is a fintech startup that was launched to address Zimbabwe’s hyperinflation by offering digital currency as an alternative to fiat money. The vision was promising, but the challenges lay in scalability and regulatory hurdles.

Kuvacash provided users with a stablecoin option that aimed to protect users from the devaluation of the local currency. The platform integrated with digital wallets to facilitate payments and exchange of currency.

However, in 2018, the Reserve Bank of Zimbabwe (RBZ) banned local banks from trading or processing payments linked to cryptocurrencies.

Lessons Learnt

Regulatory uncertainty poses a threat to adoption and growth of DeFi projects in Africa, like in the case of Kucash which launched with a solution to tackle the cash crisis in Zimbabwe.

The contrary is seen in South Africa, a more crypto-friendly country, where the Financial Sector Conduct Authority is set to issue licenses to over 60 crypto platforms. According to Bloomberg, the FSCA received over 300 license applications, a strong indication on the number of crypto companies looking for countries to invest in.

Future Prospects

Financial Inclusion

Africa’s large unbanked population can benefit from DeFi services which provide access to financial services including savings, loans and insurance. Users will be able to access these services previously reserved for the middle- and high-income earners, which could lead to a massive uptake of DeFi services over the next decade.

Stablecoin Adoption

Since many African countries suffer from high inflation rates, stablecoins can offer a more stable alternative for users to transact without fear of losing value. Stablecoins are pegged to the US dollar, and are likely to see more adoption in countries with volatile currencies including Zimbabwe, Nigeria and South Sudan. These assets could also emerge as a preferred option for cross-border payments.

Remittances

Africa has the highest remittance fees globally, with averages of about 8% per transaction. DeFi solutions drastically reduce these fees, making it easier for people to send and receive money. Users are likely to opt for DeFi to counter costly transaction fees and delays.

Integration with Mobile Money

Given the success of mobile money platforms in Africa such as M-Pesa, future DeFi platforms will likely integrate with mobile money services. The seamless integration will boost adoption among users who are already familiar with mobile money.

Recommendations for Governments and Regulators

Develop Clear Regulatory Frameworks

Governments should consider developing clear regulatory frameworks that protect investors, developers and consumers.

The Kenyan government has set up a multi-agency technical working group to advise the treasury on matters of cryptocurrency. The team is to prepare a draft of regulations that will be forwarded to the cabinet for consideration.

“Probably, we may end up with a stand-alone regulator for virtual assets. We can’t bury our heads in the sand. The more we fail to regulate, the more we risk being punished.” said the director general of the Financial Reporting Centre (FRC), Saitoti Maika.

Other countries such as Nigeria and South Africa are loosening its grip on crypto and issuing licenses to crypto-affiliated businesses.

Moreover, in Mauritius, the government has been praised for supporting digital financial initiatives including cryptocurrencies and introducing friendly crypto taxation policies. The country was ranked in the top 20 among African countries with the most Bitcoin millionaires.

Namibia, on the other hand, introduced a crypto friendly law, that allowed the use of cryptocurrencies in the country under the supervision of a watchdog. The country is yet to catch up with other pro-crypto countries, including its neighbor South Africa, but the new law is seen as a step to more crypto friendly regulations.

Support Stablecoin Adoption

In countries with currency instability, regulators can allow the controlled use of stablecoins for services such as savings and remittances, allowing citizens to avoid currency devaluation.

Public-Private Partnerships

Governments can collaborate with DeFi projects to create solutions that address local challenges such as financial inclusion and cross-border payments. There is no doubt that blockchain is the future and the sooner governments and other financial institutions accept it, the better.

“For nations to prosper, they must prioritize the support of entrepreneurs through the facilitation of free trade and an unimpeded flow of capital,” CEO of NoOnes, a said in an interview with CIO Africa.

Strategies for Improving Digital Literacy and Infrastructure

- Digital literacy campaigns – Governments, NGOs and private companies can collaborate to educate the public on DeFi and blockchain technology. This way, people will have a better understanding of how blockchain works, and the risks associated with it.

- Incorporate blockchain education in school curriculums – Incorporating blockchain education in high schools and institutions of higher learning can help equip future generations with the knowledge of DeFi and other digital finance innovations.

- Invest in Internet and mobile infrastructure – African governments should prioritize internet infrastructure development to ensure that rural areas have access to high-speed internet, which is crucial for DeFi adoption.

Conclusion

As desirable as financial decentralization sounds, such technologies often fail–and ironically, since they lack (that is, sufficiently adoption) strategies. How Africa deals with this complexity of simplicity depends on its ability to develop robust, scalable adoption strategies that balance innovation with practical implementation.

Julius Mutunkei

Jay is a highly organized reporter passionate about covering and sharing news about the blockchain, digital currencies, ICOs, altcoins, and other related topics in the cryptocurrency space. Jay understands the technicalities of the space, so he writes in a simple, understandable manner for readers from all backgrounds. His writing style has been praised for its clarity and sharp wit as he breaks down complex topics.

Avalanche L1s and the Appchain Thesis: A New Internet of Value?

How Gen AI Will Disrupt SaaS in Africa: Unbundling ERPs with Agentic AI

Emerging Markets Lead Global AI and Data Center Surge: A Paradigm Shift in Tech Geopolitics

When Reasoning Systems Take an Unexpected Turn

AI Agents and the Intelligent Software Economy: Welcome to the Age of Identic Systems

Fuel Network: Engineered Playground for the Next Generation of Apps

When Money Codes Itself: How Programmability Redefines Distribution and Value

Bitcoin Holds the Line, Institutions Stack Sats, and Ethereum Reawakens: Q2 Momentum Builds Across Crypto

Bitcoin Hits $93K as Whale Demand Surges, ETH Rebounds & Retail Sits Out

The African Remittance Dilemma: Innovation at a Cost

Subsribe To Our Newsletter

Stay in touch with us to get latest news and special offers.