Embedded Bitcoin Mining Steps to Success by Hashlabs Mining

Feb 07, 2025

Embedded Bitcoin Mining Steps to Success by Hashlabs Mining

Feb 07, 2025

Bitcoin mining has come a long way. Once an esoteric domain of cypherpunks and tech enthusiasts, the landscape has now morphed into a global industry with massive data centers. The trend in today’s data centers is to place the power of sustainable mining into the hands of enterprises, energy producers, and forward-thinking businesses. This strategic approach seeks to optimize waste energy and enhance grid efficiency.

While Bitcoin mining has been well received in Ethiopia, the risk of regulatory uncertainty, energy allocation challenges, and potential government intervention remains a concern for long-term sustainability. If increasing electricity costs or restricted access to power hinder users from entering the space, the potential for substantial business value will shrink or disappear entirely.

This challenge can be addressed by adopting the right strategy. The following five-step method by Hashlabs Mining can enhance profitability in Bitcoin mining operations.

Step 1: Minimize Costs

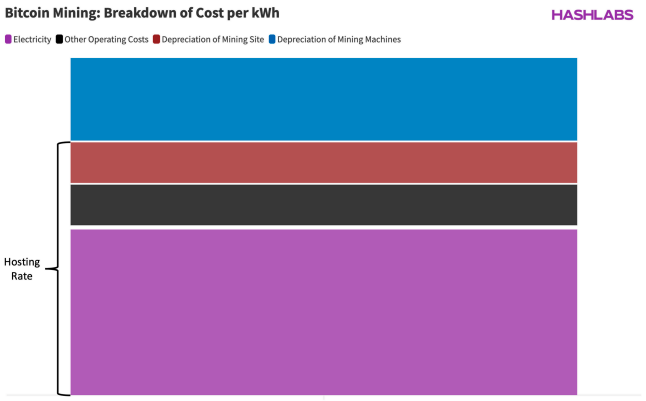

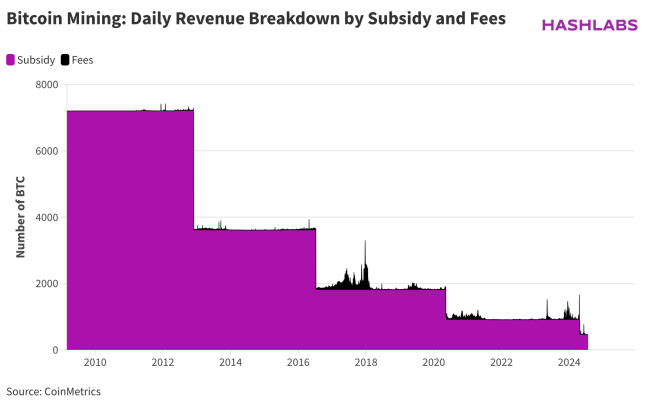

Understanding and calculating the revenue per kWh is essential to covering hosting costs—the expenses of operating the facility—while ensuring a profitable return on the investment in mining equipment. This involves entering the market during bullish cycles (Principle 1). However, sustaining profitability requires keeping costs low enough to endure the inevitable downturns of bearish cycles (Principle 2).

Maintaining a margin of safety is crucial, as future bear markets could be more severe, and frequent releases of new machines may quickly render existing models less efficient.

Step 2: Mitigate Risks

The next step is to reduce risks, including rising electricity charges, limited access to electricity, machine theft and vandalism, and natural disasters. –

- Locking up future revenues by utilizing derivatives contracts from companies like Luxor ensures that operational expenses are kept low even when market conditions are unfavorable.

- Besides, hosting services with a long-term fixed-price power purchase agreement (PPA) in place ensure greater stability in your hosting costs.

- Avoiding off-grid mining reduces the risk of electricity disruptions by not relying on a single power producer.

- Insuring your machines against natural disasters is wise if they’re in an area prone to such events.

- Ensuring physical security during transport and at the facility with guards and other measures is crucial for protecting your equipment.

- Buy from reputable brands like MicroBT for reliability, choose machines with warranties for protection, and avoid early batches prone to higher failure rates.

Bitcoin miners must mitigate risks with the correct strategies and precautions for securing equipment, managing costs, and ensuring operational continuity.

Step 3: Maximize Profits

The vast majority of mining problems can be addressed with an appropriate strategy that entails maximizing your hashrate (which determines the miner’s share of the total reward pool) and then implementing a mechanism to efficiently convert it into Bitcoin.

Frequently, miners achieve this by generating more hashrate by either buying more mining machines or upgrading to more powerful ones.

Choosing the right mining pool is crucial, as it directly impacts your revenue, with some pools paying significantly more than others. Hashlabs recommends using Nicehash, which has consistently paid 3% to 7% more than other pools.

Step 4: Choose the Optimal Machine

This can be done by choosing a machine with 20 J/TH efficiency and a 40% gross margin, though higher efficiency machines may have a higher price. Hashlabs Mining recommends selecting an ASIC miner with at least 120 TH/s, ideally 200 TH/s or more, with the Antminer S21 XP standing out among air-cooled machines at 270 TH/s.

Also, durability is key in selecting a miner, with MicroBT’s WhatsMiner often being a safer choice than Bitmain’s Antminer due to its robust construction, longevity, and performance, as demonstrated by the S19 series’ exceptional track record.

Lastly, when choosing an ASIC, focus on maximizing hashrate per dollar spent, considering factors like efficiency, durability, and payback period, and remember that higher price doesn’t always equal better value.

Step 5: Evaluate Your Bitcoin Mining Investment Properly

The final step is to put the factors above together into an investment analysis. One approach is to calculate the payback period (a key metric for evaluating investment returns), focusing on quickly recouping your initial capital due to the industry’s volatility and high risks.

Hashlabs’ approach involves:

- Calculating total investment

- Estimating daily revenue by multiplying hash price with hash rate

- Calculating daily cost by multiplying electricity consumption with cost per kWh

- Determining monthly cash flow by subtracting daily costs from daily revenue and multiplying by 30.4

The aim for a payback period is under two years, never exceeding three, depending on operation risk and the expected lifespan of your machines.

However it may be implemented and deployed, the goal of bitcoin mining is to earn higher profits—and often hidden ones—in the risks, allowing miners to capitalize on market volatility and technological advancements.

This Bitcoin mining series is part of Chaintum’s upcoming magazine publication on “Bitcoin Mining in Africa.”

So, don’t miss out on being among the first to get this edition right into your inbox: https://chaintum.io/newsletter/

Subsribe To Our Newsletter

Get the Inaugural Edition of Chaintum Magazine Right at Your Inbox