The Top 5 Myths About Real Estate Tokenization in Africa (And Why They Are Wrong)

March 5,2025

Summary

Africa’s real estate tokenization market is projected to grow by 5.58% annually; even so, myths about its feasibility, legality, and acceptance persist. Below are some misconceptions associated with the sector.

- Tokenization is only for developed markets.

- African regulators are hostile to blockchain-based real estate solutions.

- Tokenized real estate is too risky for investors.

- Tokenization will replace traditional real estate systems entirely.

- Africa lacks the infrastructure to support tokenization.

Introduction

More than 16 years after blockchain’s creation, tokenization is struggling to gain widespread institutional acceptance. While constructive criticism is healthy, Chaintum believes that some people are dismissing this innovation based on stale information, incoherent arguments, and flawed analysis.

The global tokenized real estate is projected to grow by $3 trillion by 2030. Despite its potential, misunderstandings about tokenization in Africa have held back adoption and investments.

Given Kenya’s Cabinet Secretary in charge of Information, Communications & The Digital Economy, William Kabogo, recent comments, Chaintum is revisiting the most common misperceptions weighing on its acceptance.

1. Tokenization is Only for Developed Markets

One of the most misunderstood aspects of tokenization is that it is meant solely for big, evolved markets, yet all markets of any scale can benefit from it. This idea loses credibility when you look at the developments happening in Africa.

When you hear of digital properties, it is easy to assume that tokenization can only thrive in countries with advanced financial systems. Yet, it has a greater impact on growing markets like Africa, where the conventional systems are often faulty and inaccessible.

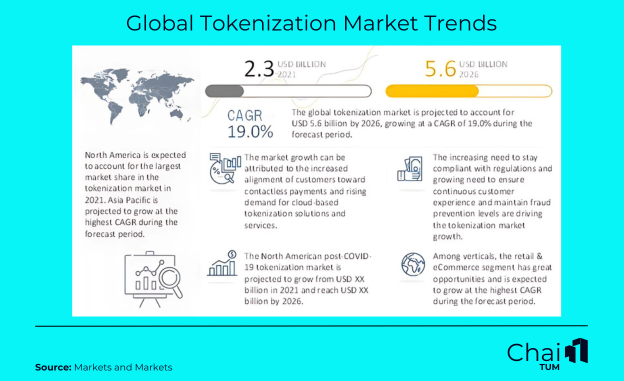

Based on the Markets and Markets report, we can understand why tokenization is a game-changer for financial inclusion and investment accessibility. Despite regions like North America having the largest market share, countries in the Asia Pacific region (Indonesia and Japan), which are relatively less developed, had the highest potential to achieve high market growth during the forecast period, as shown in Graph 1.

Besides, startups like Alphabloq in Kenya and Wealth Migrate in South Africa are leading the way in proving that tokenization works equally effectively, if not better, in developing markets.

Graph 1

2. African Regulators Are Hostile to Blockchain-Based Real Estate

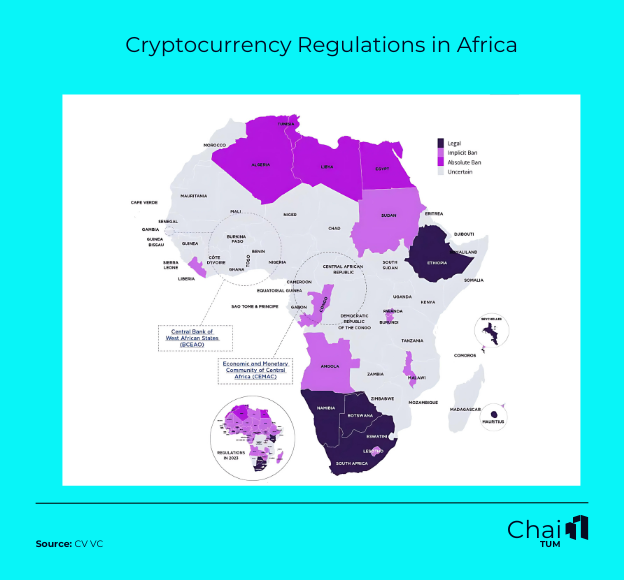

Claims that African regulators are hostile to blockchain, however, suggest a blanket assumption that doesn’t reflect the nuanced reality. In reality, the latest trends from CV VC indicate crypto is fully legal in six countries, while eight others have adopted a cautionary stance with implicit bans, as shown in Graph 2.

Blockchain is still a relatively new technology and is often mistakenly conflated with crypto, which carries a negative reputation due to scams. This misunderstanding also affects tokenization—a vital use case of blockchain. However, tokenization’s regulatory landscape is tied to the legality of blockchain itself, rather than cryptocurrency.

With tokenization being adopted in Africa, several countries, such as Kenya, South Africa and Nigeria, actively explore and apply blockchain solutions to the real estate sector. South Africa’s FSCA has introduced a regulatory sandbox for blockchain projects, enabling institutions to try inventions under regulatory supervision.

Kenya’s CMA has also adopted a regulatory playground to assess and support innovative financial solutions. Additionally, in 2024, the SEC in Nigeria approved provisional licenses for two crypto companies, Quidax and Busha, indicating a shift toward acceptance and regulation of blockchain financial solutions. These milestones prove that regulators are receptive to digitization and actively supporting it.

Graph 2

3. Tokenized Real Estate Is Too Risky for Investors

Over the years, cryptocurrencies have faced their share of disputes and volatility, which has caused doubt among investors. If you’ve heard about market crashes and crypto scams, it’s only natural to question if tokenizing properties is equally risky.

Often called a revolutionary shift in asset ownership, tokenization not only enhances security and liquidity but also lowers entry barriers for investors. While immutable and transparent, tokenization is backed by real-world assets that confer superior utility, potentially driving demand and deeming it suitable, if not superior, for the role of real estate investment.

As a suitable contender for the next evolution in real estate investment, tokenization should attract adoption similar, at a minimum, to that for REITs (Real Estate Investment Trusts) and other fractional ownership models.

4. Africa Lacks the Infrastructure to Support Tokenization

Africa’s infrastructure challenges are publicly documented, from inadequate financial networks to unstable internet access. Therefore, it is unsurprising that some will think tokenization, which requires advanced tech, won’t work here.

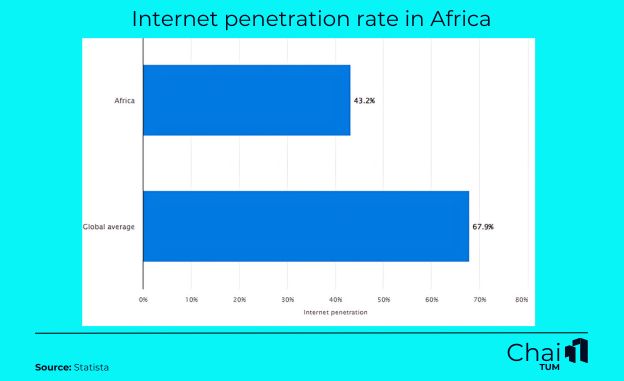

Contrary to misconception, blockchain networks like Stellar and Algorand support tokenization efforts and only require internet connectivity and mobile access, both of which are rapidly expanding across Africa. By 2029, over 1.1 billion people in Africa are expected to have internet access, which is 24.7% below the global average as shown in Graph 3. Also, GeoPoll indicated that there are 747 million SIM connections in sub-Saharan Africa, representing 75% of the population.

With Layer 2 and Layer 3 blockchains like Lightning Network, Polygon, and Arbitrum, the African population can access tokenized assets with lower transaction costs, faster processing speeds, and minimal infrastructure requirements, making participation in digital economies more inclusive.

For example, in Nigeria, Seso Global has built a private blockchain to simplify property transactions by creating a secure ledger of land titles. However, it is considering utilizing the Cardano blockchain to improve asset liquidity for global investors.

As Edward Nwokedi, the founder and CEO of RedSwanCRE, mentioned in an exclusive interview with Mariblock, “We think that’s an untapped market. And we think that the tokenization industry can start building wealth and adding value to people’s lives. … Blockchain is on a whole different level that people can’t grab to cheat or disrupt.”

Graph 3

5. Tokenization Will Replace Traditional Real Estate Systems Entirely

Real estate investors are likely to be troubled that tokenization will make traditional financing obsolete.

However, digitization is a supportive innovation that boosts liquidity by allowing fractional ownership and improving accessibility and investment opportunities while integrating with traditional systems. For example, a tokenized housing initiative in Nigeria, Mixta Africa, in partnership with Twelvevest, raised approximately $400,000 in 28 plots of land over 24 months.

Robert Muoka Salim, CEO of My Shamba Digital, says, “Our focus is on expanding our reach and adding more properties to our platform. We are dedicated to creating a thriving ecosystem that benefits all stakeholders, including investors, developers, and the broader real estate market.”

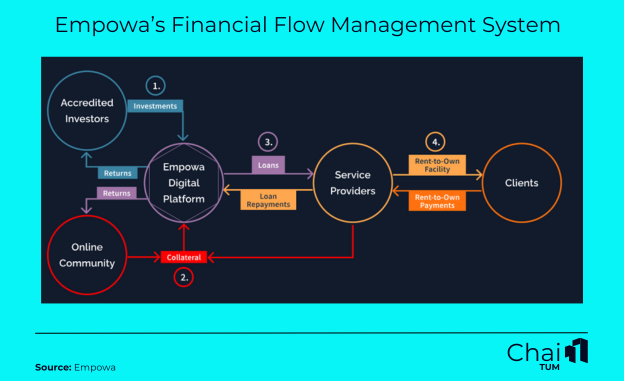

Agreeably, Empowa, a blockchain company that provides such innovative financing solutions uses this approach to address Africa’s housing shortage. It offers a flexible technology to manage bunchy cash flows—intermittent and informal—for African families wanting to own homes but previously did not qualify for mortgages. Empowa leverages tradeable SDRIs and the EMP token to de-risk affordable housing investment, using real-time tracking and local partnerships to tackle Africa’s 50-million-home deficit and unlock a $1 trillion market as shown in Graph 4.

Graph 4

The future of real estate in Africa is being reshaped by tokenization, and the opportunities it presents are too significant to ignore. The potential is undeniable, from democratizing access to investments to unlocking liquidity and fostering economic growth.

Want to stay ahead of the curve and learn more about this groundbreaking innovation? Subscribe to our newsletter and follow us on X and LinkedIn to join the conversation and be part of the future of real estate in Africa.

Subsribe To Our Newsletter

Get the Inaugural Edition of Chaintum Magazine Right at Your Inbox