When Money Codes Itself: How Programmability Redefines Distribution and Value

April 12, 2025

Programmable money, long prophesied by futurists and cryptographers, is no longer an abstract concept lingering in whitepapers or academic discourse. It is here, manifesting in the rising tide of smart contracts, stablecoin integrations, and agentic payment infrastructures, all of which have begun to reconfigure how money behaves, where power lies, and ultimately, who benefits. At the heart of this transformation is a radical question: what if money could think, act, and adapt on its own?

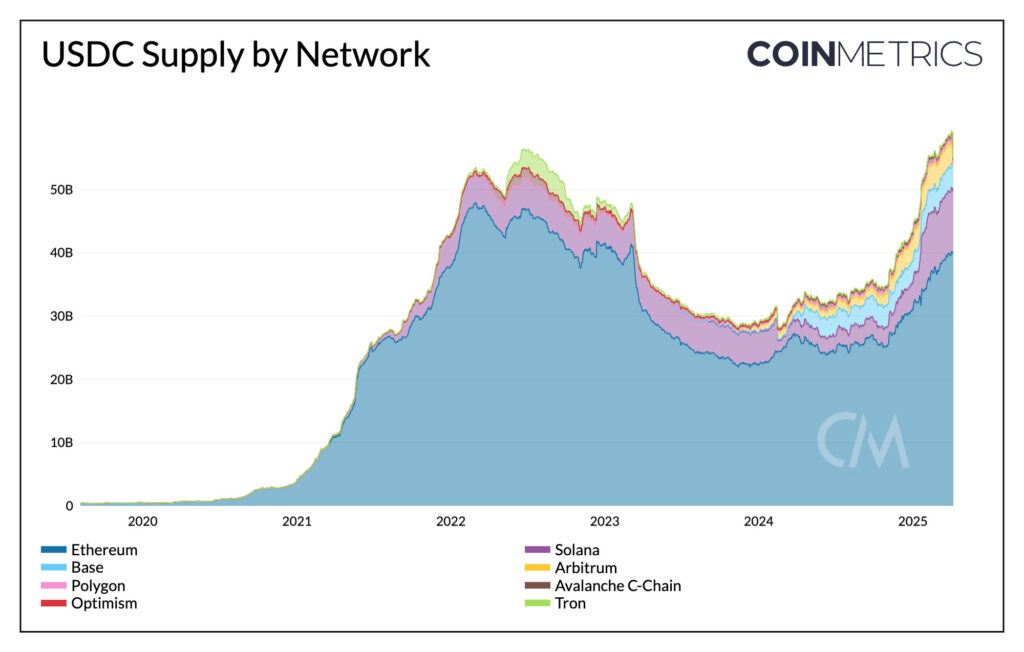

Based on emerging market signals [1], [2] we observe a major redistribution of influence. Power is no longer concentrated in the hands of the issuers but is steadily flowing downstream to distributors—wallets, apps, and platforms that actually integrate stablecoins into real-world use cases. These entities now own the user relationship, shape the experience, and increasingly dictate which stablecoins matter. In this environment, distribution isn’t just a delivery channel; it’s the value layer itself.

As Circle’s 2023 IPO filings revealed, the company paid out nearly $900 million—more than half its gross revenue—to its partners, including Coinbase, not for technical services or advisory work, but for promoting and integrating USDC [3]. The implication is seismic: stablecoin issuers are now paying distributors to be relevant as shown in Graph 1. In a reversed economic logic, the distribution pipe charges the well.

Graph 1

The Rise of Application-Aware Money

This new architecture is being reinforced by the emergence of programmable stablecoins—those equipped with embedded logic, smart contract hooks, compliance parameters, and conditional transfer rules. These upgrades are not cosmetic. They signify a broader shift toward application-aware money—stablecoins that respond dynamically to context, without the need for cumbersome off-chain agreements.

Consequently, the implications of this evolution are profound. In remittances, programmable features can auto-swap currencies based on FX rates and deliver funds in a preferred local token within seconds. In DeFi, they allow collateral assets to auto-adjust exposure or auto-liquidate in case of volatility, thereby minimizing systemic risks. In fintech integrations, such stablecoins bring embedded compliance and auditable trails directly into apps used by everyday consumers.

Based on early implementations by Visa and Stripe [4], we now see programmable money used for instant merchant settlements, affiliate routing, and pay-as-you-go licensing without touching fiat rails. In this framework, value becomes granular, dynamic, and contextual—closer to an API than a bank note.

Composability as Economic Leverage

While traditional money moves in bulk, programmable money moves in logic. This logic, being modular, connects easily with other smart contracts—an attribute called composability. In technical terms, it means one contract can “talk to” another. In economic terms, it means value can flow through chains of use, unlocking multiple layers of monetization.

For instance, a music streaming dApp could auto-split stablecoin payments between a singer, producer, and beat maker, based on predetermined percentages. A DAO managing property rentals could automatically forward taxes to the government while distributing rental yield to token holders. There is no middleman, no payroll cycle, no manual reconciliation.

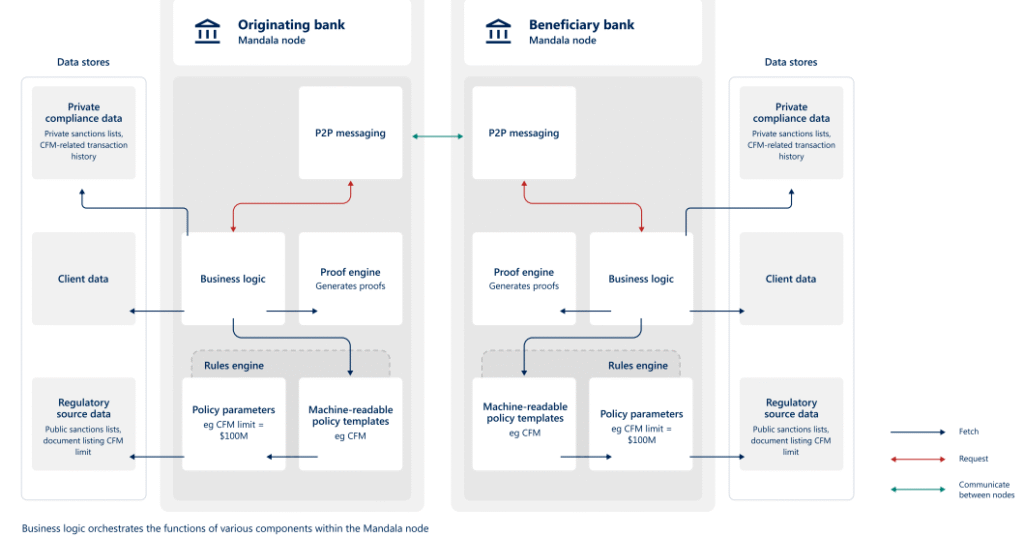

Yet, it remains to be seen whether all regulatory frameworks can keep up with this speed of value execution. In some jurisdictions, programmable transfers may conflict with legal finality or reporting rules. As such, regulatory clarity must evolve alongside technological utility to ensure confidence in cross-border programmable transactions as shown in Graph 2[5].

Graph 2

Stablecoin Infrastructure: From One-Size-Fits-All to Fit-for-Purpose

The early stablecoin infrastructure was monolithic—one stablecoin for all use cases. Today, that narrative no longer holds. Developers and issuers are rapidly unbundling functionalities and rebuilding modular infrastructure stacks to address the distinct needs of diverse industries.

Fintech startups integrating stablecoins for B2B transactions demand compliance and instant conversion to local currencies. DeFi protocols seek composability and liquidity incentives. Meanwhile, remittance platforms want gasless transactions and fast local off-ramps.

As a result, programmable money is evolving into fit-for-purpose layers, with hooks and features tailored to specific industries. Based on developer activity on chains like Avalanche and Base, we are witnessing a growing separation of concerns: the “stablecoin core” and its “application context” are no longer bundled [6]. This modularity mirrors how cloud computing evolved from monolithic servers to microservices—flexible, lightweight, and adaptive.

When Banks Join the Party

Despite widespread optimism from the crypto-native world, traditional financial institutions are not standing idle. Major U.S. banks—including JPMorgan Chase, Citigroup, and Bank of America—are reportedly exploring the launch of a joint stablecoin initiative [7]. Their objective? Regain leverage before stablecoin integration renders them irrelevant.

Through Early Warning Services (which powers Zelle) and the Clearing House, these institutions are eyeing programmable stablecoins not as a novelty, but as an inevitable extension of real-time payments. If successful, this move could blur the lines between central bank digital currencies (CBDCs), bank coins, and permissioned stablecoins—all operating within compliant, interoperable rails.

However, integration won’t be without friction. Trust, privacy, and composability will become contested terrains. Unlike decentralized programmable money, bank-led stablecoins may prioritize control and surveillance over flexibility and user autonomy. This bifurcation—open vs closed, flexible vs compliant—could define the next phase of competition in financial infrastructure.

The African Context: A Case of Leapfrogging?

In Africa, programmable money offers more than utility; it promises financial evolution. Countries with fragmented payment systems and low card penetration could leapfrog into a programmable money ecosystem that is natively digital, context-aware, and inclusive. A cross-border driver in this regard is remittance, which, according to the World Bank, accounts for over 6% of GDP in several African nations [8].

For African developers, programmable stablecoins unlock tools to embed financial logic directly into products—be it rent-to-own real estate platforms, savings groups (chamas), or digital agriculture cooperatives. Based on pilot experiments in Kenya and Nigeria, micro-disbursements using programmable money reduced fraud in farmer subsidy schemes by over 40% [9].

Moreover, programmable liquidity pools for stablecoins in DeFi are beginning to offer diaspora Africans new ways to invest back home—into tokenized solar panels, mini-grid loans, or regenerative agriculture projects. If regulated correctly, this programmable liquidity could turn brain drain into capital gain.

The Bigger Picture: Financial Systems as Smart Protocols

What’s emerging is not merely programmable money but programmable economies. Money is the entry point—but behind it lies the ability to script policy, incentives, risk-sharing, and governance in code.

As smart contract standards like ERC-7529 (for programmable transfers) and ERC-7620 (for compliance modules) gain traction, it’s possible that most financial logic—salary distribution, tax withholding, insurance underwriting—will be programmable by default. The stablecoin becomes not just a medium of exchange but a dynamic actor in the financial play.

Should this trend continue, entire sectors may be reimagined: payroll becomes real-time streaming; insurance becomes usage-based; and savings accounts become composable yield routers. Consequently, the role of governments and central banks could shift from monetary architects to protocol auditors and certifiers of compliance.

Final Reflections: Not Just Money—Intelligence in Motion

Programmable money is not just about new types of payment; it’s about infusing intelligence into value. Each transaction becomes more than a transfer—it becomes an action, a rule, a conditional decision. It carries with it context, code, and consequence.

As stablecoins become application-aware, Africa’s innovators, developers, and regulators will need to think beyond integration. They will need to ask: what logic should money follow? Who writes this logic? Who audits it? And who benefits from the flow?

Because when money starts to think, the people who teach it what to think will shape the next economic epoch.

References

- Mastercard. 2025. “Mastercard Unveils End-To-End Capabilities to Power Stablecoin Transactions – from Wallets to Checkouts.” Mastercard.com. April 28, 2025. https://www.mastercard.com/news/press/2025/april/mastercard-unveils-end-to-end-capabilities-to-power-stablecoin-transactions-from-wallets-to-checkouts/.

- Harms, hris . 2025. “Predictions for 2025: The Rapid Rise of Stablecoins Continues.” Financial IT. 2025. https://financialit.net/blog/stablecoins-cryptocurrencytrends-bitcoin/predictions-2025-rapid-rise-stablecoins-continues.

- Ved, Tanay. 2025. “Unpacking Circle’s IPO Filing and USDC’s On-Chain Footprint.” Substack.com. Coin Metrics’ State of the Network. April 15, 2025. https://coinmetrics.substack.com/p/state-of-the-network-issue-307.

- Mason, Emily. 2025. “Visa, Stripe’s Bridge Partner to Streamline Stablecoin Cards (V).” Bloomberg.com. Bloomberg. April 30, 2025. https://www.bloomberg.com/news/articles/2025-04-30/visa-and-stripe-s-bridge-partner-to-streamline-stablecoin-cards.

- BIS. 2024. “Streamlining Cross-Border Transaction Compliance Project Mandala Streamlining Cross-Border Transaction Compliance Project Mandala.” https://www.bis.org/publ/othp87.pdf.

- Chamria, Dr. Ravi . 2025. “How Avalanche Became the Perfect Platform to Launch 100+ L1s in 2025?” Blockchain Deployment and Management Platform | Zeeve. May 2, 2025. https://www.zeeve.io/blog/how-avalanche-became-the-perfect-platform-to-launch-100-l1s-in-2025/.

- Rodrigues, Francisco. 2025. “Major U.S. Banks, like JPM, Citi, BoFA, and Others, Mull Joint Stablecoin Launch: WSJ.” CoinDesk. May 23, 2025. https://www.coindesk.com/business/2025/05/23/major-us-banks-mull-jointly-launching-stablecoin-wsj.

- United Nations. 2023. “The Transformative Power of Digital Remittances in Africa | Office of the Special Adviser on Africa.” Un.org. 2023. https://www.un.org/osaa/news/digital-remittances-africa.

- Schroeder, Kateryna, Julian Lampietti, and Ghada Elabed. 2025. “What’s Cooking: DigitalTransformation of the Agrifood System.” https://documents1.worldbank.org/curated/en/417641615957226621/pdf/Whats-Cooking-Digital-Transformation-of-the-Agrifood-System.pdf.

Want to stay ahead of the curve and learn more about this groundbreaking innovation? Subscribe to our newsletter and follow us on X and LinkedIn to join the conversation and be part of the future of real estate in Africa.

Subsribe To Our Newsletter

Get the Inaugural Edition of Chaintum Magazine Right at Your Inbox