Here's How Kotani Pay is Shaking Up Cross-Border Payments in Africa with a Splash of Stablecoins

Oct 23, 2024

Here's How Kotani Pay is Shaking Up Cross-Border Payments in Africa with a Splash of Stablecoins

Oct 23, 2024

“Ideas don’t matter much. What matters is the customers’ problem and if you solve it,”-said Felix Macharia, the CEO of Kotani Pay in a Hustle Yangu Show episode.

Kotani Pay has already included stablecoins in its popular on-ramp/off-ramp app. But the company is taking a methodical approach in rolling out its innovation to promote financial inclusion in Africa.

Having announced in July that it became the first on-ramp/off-ramp blockchain fintech to secure a Crypto Asset Service Provider (CASP) license from South Africa’s Financial Sector Conduct Authority (FSCA), Kotani Pay aims to further simplify payments in local African currencies across Africa.

In the recent past, the company has implemented stablecoins for cross-border settlement to enable customers to send and receive funds within minutes across Africa. The primary focus centered on three key use cases aimed at allowing users to transact in their chosen currency, preserving value while also saving time and reducing costs.

One is to provide businesses with stablecoin/fiat for their liquidity needs via its Stablecoin Settlement Solution.

For Kotani, stablecoins are more than just a passing trend; they signify a fundamental change in how people view and engage with money.It aims to use this digital asset to change how businesses transact, save, invest, and access financial services.

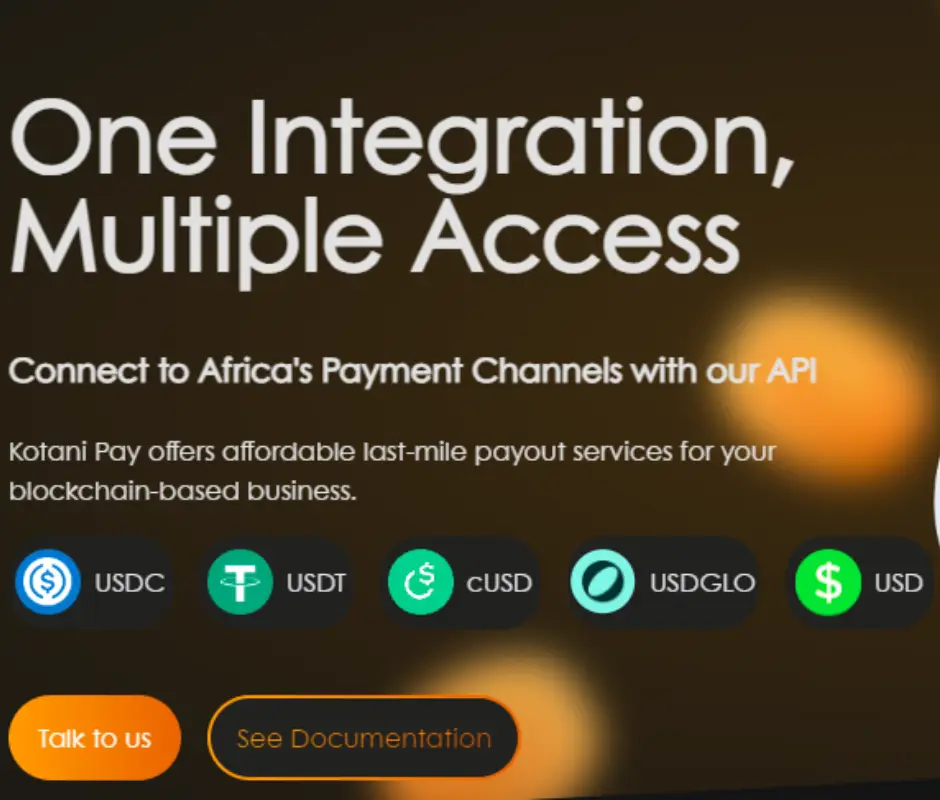

Another similar feature is its blockchain-powered APIs that allow users to connect their dApp wallets to local payment channels in Africa. If a business integrates Kotani Pay’s API, it benefits from affordable last-mile payout services in stablecoins like USDC, USDT, cUSD, USD GLO, and also in USD.

“Our API also offers instant conversion of crypto-currency payments into local currency, protecting merchants from price volatility. This means businesses can easily integrate our solution to enable their customers to make purchases and transactions at retail stores using cryptocurrencies,” said Felix Macharia, the CEO of Kotani Pay.

Finally, Kotani Pay has an SMS-based blockchain wallet that allows users to enjoy full blockchain functionalities without the internet. People can send and receive money with this non-custodial wallet, receiving instant SMS notifications upon withdrawing funds—all while benefiting from a secure account protected by a 4-digit PIN.

Photos by Kotani Pay on kotanipay.com/

Stablecoins Could Make Cross-Border Remittance More Effective

” Stablecoin is not different from other crypto-only by having a mechanism that allows it to have a 1:1 mechanism,” says George Musomi during the Kenya Blockchain and Crypto Conference (KBCC).

“When giving aid, one biggest challenge we have is infrastructure, and that is why it was easy to deliver aid in the form of stablecoins to Ukraine—this is why digital literacy matters” added Juliet Kanjukia, Senior Associate, Project Management, Save the Children.

Kotani Pay isn’t alone in weaving stablecoins into its application. Eversend, which also supports stablecoins, has been pushing ahead with its own multicurrency wallet that enables users to store and trade various currencies with fair and transparent exchange rates. These innovations usher in the “next phase,” whereby fintech services must look for a common thread that brings African countries together—amidst having different nuances and beliefs—to enter markets that were previously using mobile money, said Felix.

The accessible nature of mobile money in Africa, which allows users to share funds, organize transactions, and keep track of financial activities, can sometimes create a significant obstacle, with users finding it difficult to transfer money between different mobile money providers. Stablecoins can help by allowing cross-border settlements in different countries within minutes without the issue of provider dependency.

Stablecoins also lower transaction fees since they run on decentralized blockchain networks—a challenge users face when using traditional transfer methods that require currency conversion charges and include unfavorable exchange rates.

“The industry had a major milestone last year, in August 2023, when stablecoin volumes surpassed payment giants like Visa and Mastercard.” Felix commenced a fireside chat on “Onboarding Millions of Users Across Africa to Web3” during the Africa Tech Summit on February 14th & 15th 2024. “Remittance is a very important use case that Web3 can address… The main barrier people (who send money back home from abroad) face is the high fees and the unavailability of an easy way to do these things,” argued Tosin Onikosi, a Web 3 Product Marketing Lead at Opera.

Photos by Kotani Pay on kotanipay.com/

Tackling Stablecoin “Hallucinations”

Along with the numerous benefits of stablecoins in remittance apps, there are drawbacks to using them to promote intra-trade in Africa due to the lack of a coordinated regulatory regime. Stablecoin integration for trade is prone to hallucinations—causing uncertainty among especially businesses and consumers, who may hesitate to adopt stablecoins for their transactions.

One tack Kotani Pay has taken is to provide transparency via working with policymakers to achieve regulatory compliance. This is done by contributing to lobbying efforts for comprehensive crypto policy frameworks, as witnessed with its engagement with the Blockchain Association of Kenya that led to the birth of the Virtual Asset Service Providers Bill.

“It’s indisputable that the world has gone borderless—thus innovation knows no borders. If my homeland doesn’t let my ideas flourish, I’ll just find a new place to plant them,” said S.A. Kakai, a Crypto Assets Legal Expert. It’s quite clear where all of this originates —this is one way to guard against stablecoin expansion hallucinations.

And if one country can’t provide legal attribution to an innovation, the innovator can look and expand to a market where policies are favorable.

Therefore, Kotani has been intentionally selective about where to extend its services. Stablecoin hallucinations are more common when innovations are country-specific, which means they become ineffectual when a regulator doesn’t consider them a good fit. If a huddle isn’t jurisdictional, stablecoin-powered remittance platforms might just install the whole solution to meet consumer needs elsewhere. That’s why Kotani Pay has expanded its operations beyond Kenya to South Africa, Cameroon, and Tanzania.

The concluded micro-loan pilot together with Haraka, Clixpesa, and MentoLabs showed that local stablecoins can democratize finance in Africa. Since its launch in May 2024, the initiative has utilized the Kenya Shilling stablecoin, cKES, to empower local entrepreneurs by relying on community and peer-driven creditworthiness scores. So far, more than 1 million cKES have been distributed to 150 microentrepreneurs.

Those are the kinds of issues that make people think that stablecoins for cross-border payments are going to fail, but there must be internal guardrails. Still, stablecoins have proven reliable for payment use cases, especially for Africa that experiences cross-provider problems.

Taking the First Steps

Every company with a regional presence in the continent stands to benefit from stablecoins, no matter how distinctive its challenges are or which sector it falls under. However, taking the first step often raises enough questions to make one hesitant: Will it disrupt current operations? Are there proper systems in place? What effect will this have on overall workflows?

Due to the lack of enterprise-level solutions, stablecoins in Africa have mostly operated within a “shadow economy” since their inception, but Kotani Pay’s on-ramp/off-ramp API allows businesses to access multiple payment platforms, custom pricing, real-time rates, real-time settlement, and direct payment to merchants. Doing so has opened up the use case for stablecoins in business settlements across the continent.

One of the advantages of developing an API that can integrate natively in business systems is the ability to deliver personalized solutions for their remittance, exchange, wallets, decentralized finance (DeFi), and savings needs.

That is why partnering with Mento Labs—a decentralized cUSD (Celo Dollar) stablecoin that follows the US dollar—as Kotani Pay expands its range of use cases is key to providing seamless cross-border payments. With a partner that has both the technology and expertise, this collaboration drives digital currency adoption and boosts financial stability in deflation-hit Africa.

“At Mento Labs, we understand the critical role that on- and off-ramp solutions play in regions where traditional financial infrastructure is limited. Partnering with Kotani Pay allows us to extend the reach of the cUSD stablecoin on the Mento Platform and provide users in Africa with seamless access to digital financial services,” said Dr. Markus Franke, CEO at Mento Labs. “Our collaboration highlights the importance of building robust infrastructure to support the growing demand for digital financial solutions in emerging markets.”

The world of [on-ramp/off-ramp] is [at a] very early stage, meaning users will continue to have regulatory uncertainty, limited infrastructure, volatility, liquidity, and interoperability concerns. It will take time to normalize stablecoin settlements, as governments, financial institutions, and businesses will need to collaborate on integrating it into mainstream financial services.

Avalanche L1s and the Appchain Thesis: A New Internet of Value?

How Gen AI Will Disrupt SaaS in Africa: Unbundling ERPs with Agentic AI

Emerging Markets Lead Global AI and Data Center Surge: A Paradigm Shift in Tech Geopolitics

When Reasoning Systems Take an Unexpected Turn

AI Agents and the Intelligent Software Economy: Welcome to the Age of Identic Systems

Fuel Network: Engineered Playground for the Next Generation of Apps

When Money Codes Itself: How Programmability Redefines Distribution and Value

Bitcoin Holds the Line, Institutions Stack Sats, and Ethereum Reawakens: Q2 Momentum Builds Across Crypto

Bitcoin Hits $93K as Whale Demand Surges, ETH Rebounds & Retail Sits Out

The African Remittance Dilemma: Innovation at a Cost

Subsribe To Our Newsletter

Stay in touch with us to get latest news and special offers.