Stablecoins in Africa: Foundations of a Quiet Currency

March 25, 2025

The financial ecosystems of Africa, long characterized by volatility, limited access, and institutional inefficiencies, are on the cusp of a monumental shift. Based on a synthesis of various market studies [1][2][3], stablecoins—digital assets pegged to traditional currencies—are fast emerging not just as an alternative payment mechanism, but as a foundational layer for the next iteration of Africa’s economic infrastructure.

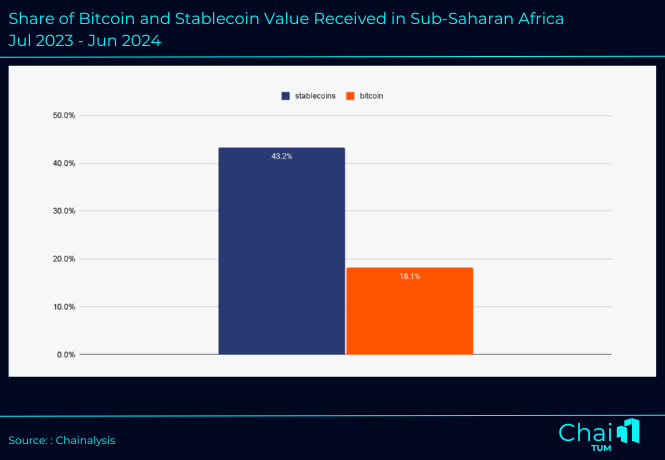

In 2024 alone, stablecoins accounted for approximately 43% of Africa’s total crypto transaction volume, a remarkable statistic given the fragmented banking systems, volatile currencies, and regulatory ambiguities that define many African markets. Yet, it remains to be seen whether the current momentum can be consolidated into systemic transformation.

Graph 1

The phenomenon is no accident. With inflation rates exceeding 20% in economies like Nigeria, Ghana, and Zimbabwe, and with currency devaluations reaching critical levels, stablecoins offer a vital hedge against value erosion. The cost of sending remittances to Africa still averages 8–10% of the transaction value, according to World Bank figures, further underscoring the urgent need for cheaper, more reliable alternatives.

Consequently, the implications of stablecoin adoption extend well beyond speculative trading or hedging. They signal a profound reordering of how Africans store value, settle debts, and interact across borders—fundamentally challenging the conventional financial hierarchy.

The Drivers of Stablecoin Adoption

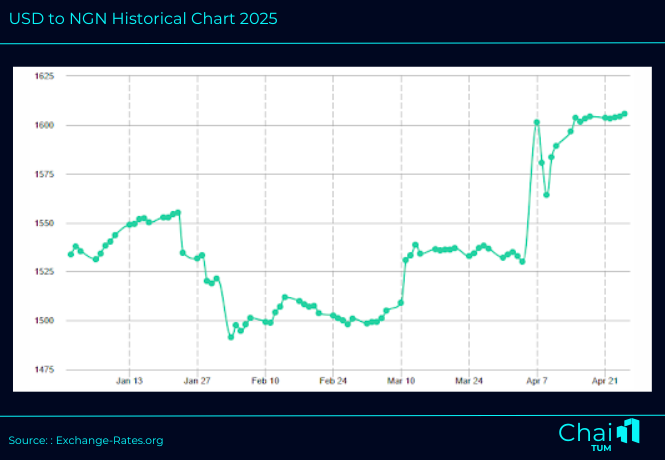

Several underlying forces explain why stablecoins are gaining traction across the continent. First and foremost is the sheer need for financial stability amidst local currency chaos. Based on data from Exchange-Rates.org, the Nigerian naira lost over 4.6% of its value against the U.S. dollar in 2025 alone as shown in Graph 2. Similarly, Ghana’s cedi depreciated by nearly 50% over two years.

In this environment, stablecoins like USDT, USDC, and cUSD provide a lifeline. They are being used not merely for investment but for everyday activities:

- Small merchants in Nairobi settle imports from China directly in USDT

- Farmers in rural Kenya use mobile apps to save earnings in cUSD, bypassing unreliable local banks

- Families in Accra receive diaspora remittances directly into stablecoin wallets, avoiding Western Union’s punitive fees

The value proposition here is clear: stablecoins represent low-cost, stable, and borderless money in an otherwise unstable and fragmented landscape.

Graph 2

Key Regional Hotspots

Notably, certain regions have emerged as stablecoin strongholds:

- Nigeria, which leads the continent, processed over $21.8 billion in stablecoin transaction volume in 2024

- Kenya, already famous for M-Pesa, is quietly integrating crypto payments alongside mobile money infrastructure

- South Africa is making steady regulatory progress, with the Financial Sector Conduct Authority (FSCA) preparing clearer stablecoin frameworks

In short, where inflation eats wealth and bank access lags, stablecoins are filling the gap—swiftly, and without waiting for bureaucratic approval.

Fork in the Road: Two Futures for Stablecoins

Despite their promise, stablecoins are at the crossroads, facing two possibilities:

- Business As Usual

If regulators continue to treat stablecoins with suspicion or indifference, growth will remain confined to gray markets. Financial exclusion will persist for the majority, and illicit activities could flourish within opaque peer-to-peer ecosystems.

- Embracing Change

Alternatively, governments could enact pragmatic regulation: sandbox programs, tax-compliant gateways, and partnerships with innovators. In doing so, they would amplify financial inclusion, empower entrepreneurs, and attract global capital.

Ultimately, the difference between these two outcomes hinges less on technology itself and more on regulatory imagination—or the lack thereof.

Technology and Infrastructure Synergies

Based on various analyses [4] [5], Africa’s readiness for stablecoin adoption is largely fueled by its mobile-first digital economy. With smartphone penetration nearing 50% and mobile money usage booming across East and West Africa, the barriers to entry for stablecoins are remarkably low compared to other regions.

Platforms like M-Pesa in Kenya and MTN Mobile Money in West Africa have cultivated a user base comfortable with digital transactions, wallets, and even QR code payments. Based on Chaintum’s forecasts, this technological maturity could accelerate stablecoin integration into everyday commerce, allowing for frictionless peer-to-peer transactions, stable-value savings products, and decentralized finance (DeFi) services tailored to African users.

DeFi apps built on open blockchain standards are already offering stablecoins in hubs like Lagos, Nairobi, and Cape Town. Examples include Kotani Pay, Quidax, Luno, Busha, etc. Consequently, the technological backbone needed to support stablecoin usage—not just for remittances, but for agriculture, e-commerce, and healthcare payments—is already falling into place.

Yet, it remains to be seen whether improvements in internet connectivity and mobile infrastructure, particularly in rural regions, can keep pace with the explosive growth in digital financial services.

Stablecoins vs. Central Bank Digital Currencies (CBDCs)

Parallel to the rise of stablecoins is the emergence of CBDCs. Nigeria’s eNaira has already been launched, while Ghana’s e-cedi and South Africa’s Project Khokha continue pilot phases.

However, stablecoins and CBDCs are not synonymous.

Nigeria’s eNaira project, for instance, has been met with lukewarm adoption compared to USDT and BUSD usage among the populace. While CBDCs offer legal clarity and direct regulatory oversight, they often fail to address users’ core motivations for adopting stablecoins—namely, privacy, borderless utility, and independence from domestic inflationary pressures.

Based on interviews with African fintech and policy leaders [6], it appears that many users see CBDCs as “government money by another name,” offering few advantages over existing fiat currencies. Consequently, the landscape ahead may be defined by hybrid models where private stablecoins coexist with public digital currencies, each serving different market segments.

Real-World Evidence of Transformation

Examples of stablecoins at work are already abundant:

- Quidax, a regulated Nigerian exchange, has partnered with Tether ($USDT) to promote education in Nigeria and Ghana, with CEO Buchi Okoro highlighting stablecoins like USDT as a secure and efficient way for Africans to store value and transact amid growing interest in digital assets.

- Fully licensed in Cameroon and authorized to operate in six Central African countries, digital-first banking platform Azamra is aiming to expand its lending services through the use of stablecoins.

- A survey by a technical working group from Kenya’s Capital Markets Authority (CMA) and Central Bank (CBK) found that private firms are increasingly using stablecoins like USDT, with 49% relying on it to pay foreign suppliers.

- Developers are piloting stablecoin-backed microloans, bypassing traditional banking altogether.

In short, stablecoins are not a hypothetical solution—they are an operational reality.

Challenges Ahead: Regulatory, Educational, Infrastructural

Nonetheless, systemic challenges loom large:

- Regulation remains fragmented. Without harmonized cross-border frameworks, stablecoin usage could remain patchy and vulnerable to sudden crackdowns.

- Financial literacy is uneven. While urban youth may grasp stablecoin concepts quickly, rural populations require targeted education initiatives.

- On- and Off-Ramp Issues: While users may easily acquire stablecoins through peer-to-peer platforms, converting back to local fiat currency remains costly and logistically complex, especially in rural areas with limited agent networks.

- Technological gaps persist. Particularly in rural regions, poor network coverage and limited smartphone access threaten to widen digital divides.

These challenges beg the question: can this momentum be sustained without systemic support? Based on data from EMURGO Africa [7], institutional involvement—particularly from fintech startups, mobile network operators, and even traditional banks—will be critical in scaling stablecoin applications beyond remittances and trading into areas such as microinsurance, agricultural financing, and cross-border B2B commerce. Stablecoins, if embedded into broader digital ecosystems, could catalyze a new wave of financial services designed for the realities of African economies rather than imported models ill-suited to local contexts.

Here’s the list of 28 leading African fintechs partnering with Circle’s new stablecoin network, as stablecoins continue to dominate crypto use in Africa, especially for easing cross-border transactions.

Conclusion: The Future Is Being Written in Stablecoins

Despite the inevitable hurdles, stablecoins are not just an evolutionary footnote; they are a foundational force reshaping Africa’s financial destiny.

Whether through faster remittances, cross-border trade facilitation, inflation hedging, or democratized savings products, stablecoins have already demonstrated tangible value to millions of Africans. Should the regulatory and infrastructural pieces fall into place, the impact could be nothing short of transformative: an inclusive, borderless economy operating at the speed of trust.

Africa has leapfrogged before—with mobile phones, with fintech, with renewable energy.

With stablecoins, it is poised to leap even further—and faster—into a digitally sovereign future.

Want to stay ahead of the curve and learn more about this groundbreaking innovation? Subscribe to our newsletter and follow us on X and LinkedIn to join the conversation and be part of the future of real estate in Africa.

Subsribe To Our Newsletter

Get the Inaugural Edition of Chaintum Magazine Right at Your Inbox